- Joined

- Jun 2, 2013

- Messages

- 3,413

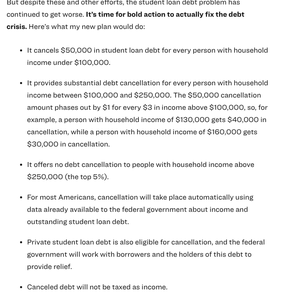

True. My response was engendered by the blanket "Hell no, no way should anyone's student loans be forgiven" responses here that did not address any of the problems which have given rise to Ms. Warren's proposal.All of these points are valid @MollyMalone but they don't address Ms. Warren's current plan to wipe out debt across the board up to $50K which was the original question. That is not the way to fix all the things you have so eloquently laid out.

300x240.png)