How Are Diamonds Made? Natural vs Lab-Created Explained

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

PriceScope delivers monthly insights into the natural diamond market for consumers, traders, and industry professionals. This July report captures the latest shifts in pricing trends across premium, mid-range, and lower-grade natural diamonds, shaped by lab-grown competition, evolving shape preferences, and tightening global supply. It incorporates insights from respected sources such as Rapaport and IDEX, while highlighting trade impacts from tariff fluctuations and market sentiment at international events like JCK Las Vegas.

Where can I buy loose diamonds? Shop over 437,378 loose natural diamonds at PriceScope. Featuring premium natural diamonds from the likes of Whiteflash, James Allen, Blue Nile, Adiamor, B2C Jewels, and more.

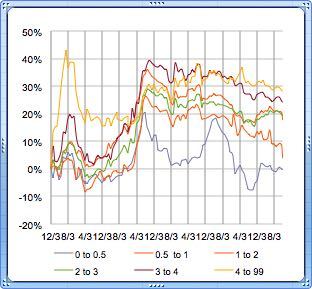

| ROUND Natural Diamond Price Changes For The Last 3 months | |||

| Diamond Carat Sizes | 5/1/2025 | 6/1/2025 | 7/1/2025 |

| 0.0 – 0.5 | 3 % ↑ | 0 % | 0 % |

| 0.5 – 1.0 | 5 % ↑ | -2 % ↓ | 1 % ↑ |

| 1.0 – 2.0 | 3 % ↑ | -1 % ↓ | 0 % |

| 2.0 – 3.0 | 2 % ↑ | 0 % | -1 % ↓ |

| 3.0 – 4.0 | 2 % ↑ | -1 % ↓ | 0 % |

| 4.0 – 99 | 2 % ↑ | -1 % ↓ | -1 % ↓ |

According to recent reports, the 1‑carat RAPI index fell 0.3% in June, reflecting cautious sentiment amid global uncertainty and U.S. tariff tensions. Premium natural diamonds performed well at international shows such as JCK Las Vegas, reaffirming market confidence in top-quality stones.

At the same time, the lab-grown market continues to disrupt lower- and mid-tier categories. Wholesale prices for synthetics have dropped as much as 95% from their 2018 levels, with a 1.5 ct. lab-grown diamond now averaging just $1,455. Surveys show that nearly 80% of Gen Z consumers prefer lab-grown diamonds for budget or sustainability reasons. These shifts are not only reshaping entry-level demand but are also forcing traditional retailers to rethink value propositions across the board.

On the supply side, natural diamond output is expected to grow by only 1-2% annually through 2027. This limited growth is placing structural constraints on global supply, offering price stability in premium segments. Meanwhile, major producing countries and industry bodies are responding to the lab-grown surge with unified branding and investment efforts. The Luanda Accord, for instance, sees stakeholders like Angola, Botswana, and India’s GJEPC pledging 1% of rough diamond revenue toward the promotion of natural diamonds globally.

Symbolic campaigns such as Antwerp’s recent €5 lab-grown diamond giveaway have further drawn attention to the divide between natural and synthetic stones. Prompting sharp criticism from natural diamond leaders in Surat and elsewhere and reinforcing the need for clearer category distinction at the consumer level.

The natural diamond market in July 2025 revealed renewed strength in premium-grade stones, continued volatility in mid-range offerings, and lingering pressure on lower-grade diamonds. As competition from lab-grown diamonds intensifies, July’s data underscores a market in transition. Value, rarity, and shifting consumer behavior continue to drive price movements across categories.

Premium diamonds demonstrated stronger performance in July. D/FL prices increased modestly to $12,840 from $12,586, while D/IF held firm at $13,230, slightly above June’s figure of $13,224. E/FL and E/IF also posted marginal increases, suggesting steady demand for flawless and internally flawless stones. Notably, F/IF surged from $8,128 to $11,264, marking a significant jump that may reflect either reclassification or a rise in demand for very high-clarity diamonds.

These movements indicate a subtle resurgence in consumer and investor confidence at the upper end of the market. Despite ongoing pressures in other segments, buyers continue to favor premium quality. This reaffirms the enduring value proposition of natural diamonds at the highest clarity levels.

Mid-range clarity and color combinations presented mixed results in July. F/VVS2 increased sharply to $8,450 from $7,560, reflecting a stronger interest in diamonds that offer a balance of high clarity and accessible pricing. In contrast, H/VS1 softened slightly to $4,712 from $4,759, while E/VVS2 dipped to $7,960 from $8,053. G/VS1 and G/VS2 also experienced marginal adjustments, indicating fluctuating demand.

Overall, the mid-range segment continues to attract steady interest. Buyers appear more discerning, seeking optimal value within this quality tier. These shifts reflect heightened price sensitivity and greater comparisons to lab-grown alternatives that provide similar visual appeal at lower costs.

Lower-grade diamonds remained under pressure in July, although a few segments showed tentative signs of stabilization. I/SI1 slipped to $3,221 from $3,349, and J/SI1 edged down slightly to $2,537 from $2,550. However, K/SI2 recorded a modest increase, climbing from $1,834 to $1,849, suggesting early signs of resilience at the entry-level.

Despite these slight movements, the broader trend in lower-grade stones continues to point toward cautious consumer spending. Price-conscious shoppers increasingly favour lab-grown options that offer more carat weight for less investment.

The July trends reflect a market divided by clarity and price tier. Premium stones are regaining traction, supported by niche demand and the lasting prestige of high-quality natural diamonds. Mid-range diamonds are undergoing subtle realignment as consumers evaluate value more closely. Lower-grade diamonds remain challenged, although some categories hint at recovery.

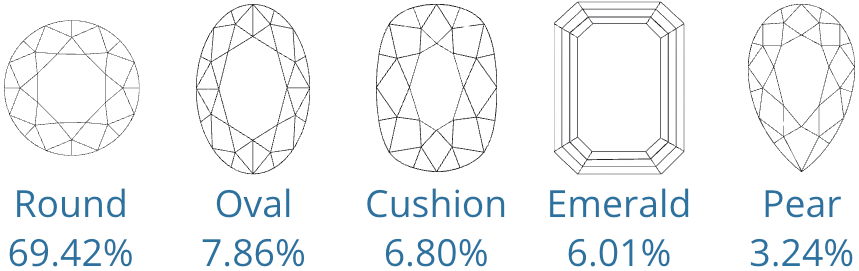

In July 2025, the natural diamond market continued to showcase shifting consumer tastes across the Top 5 Popular Natural Diamond Shapes. While traditional preferences held strong, subtle changes within the top-ranking cuts reveal evolving interest in certain alternative styles.

Round diamonds remain the most popular diamond shape on the market, climbing from 67.87% in June to 69.42% in July (+1.55%).

Oval diamonds continued their downward trajectory, slipping from 8.88% to 7.86% (–1.02%). Though still a popular modern shape, demand appears to be easing as buyers gravitate back toward more classic fancy cuts.

Cushion diamonds saw a notable increase in popularity, rising from 5.87% to 6.80% (+0.93%). Their soft edges and vintage appeal may be resonating more with consumers seeking a balance between classic and distinctive.

Emerald diamonds, known for their clean, linear facets, declined from 6.79% to 6.01% (–0.78%). The dip suggests a cooling in demand for step cuts, possibly due to their more understated brilliance compared to brilliant-cut alternatives.

Pear-shaped diamonds edged up slightly from 3.14% to 3.24% (+0.10%), indicating a minor resurgence of interest in this distinctive teardrop silhouette, though it remains the least dominant shape in the Top 5.

In closing, the natural diamond market reveals ongoing strength in premium clarity grades and a continued consumer preference for round shapes. Mid-tier and lower-grade categories remain sensitive to lab-grown disruption and pricing pressure. A constrained global supply outlook paired with active promotional efforts from natural diamond stakeholders is helping stabilize the upper end of the market. For vendors, adapting shape-based inventory strategies and reinforcing the long-term value of natural diamonds will be key to maintaining market share.

PriceScope continues to provide timely data and expert analysis through our Diamond Price Chart pages, supporting buyers and sellers as the market evolves across both natural and lab-grown diamonds.

Retail Diamond Prices Chart Updated Monthly.

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

A Wedding Ring as Unique as Your Love Finding the right wedding ring isn’t just about diamonds or gold – it’s about finding the one that feels right. With hundreds…

So, you’re thinking about lab-grown diamonds? Smart move. They’re just as sparkly as the natural kind but usually cost less. But where do you actually go to buy them? It…

Want to stay updated on the most recent blogs, forum posts, and educational articles? Sign up for Bling News, PriceScope’s weekly newsletter.