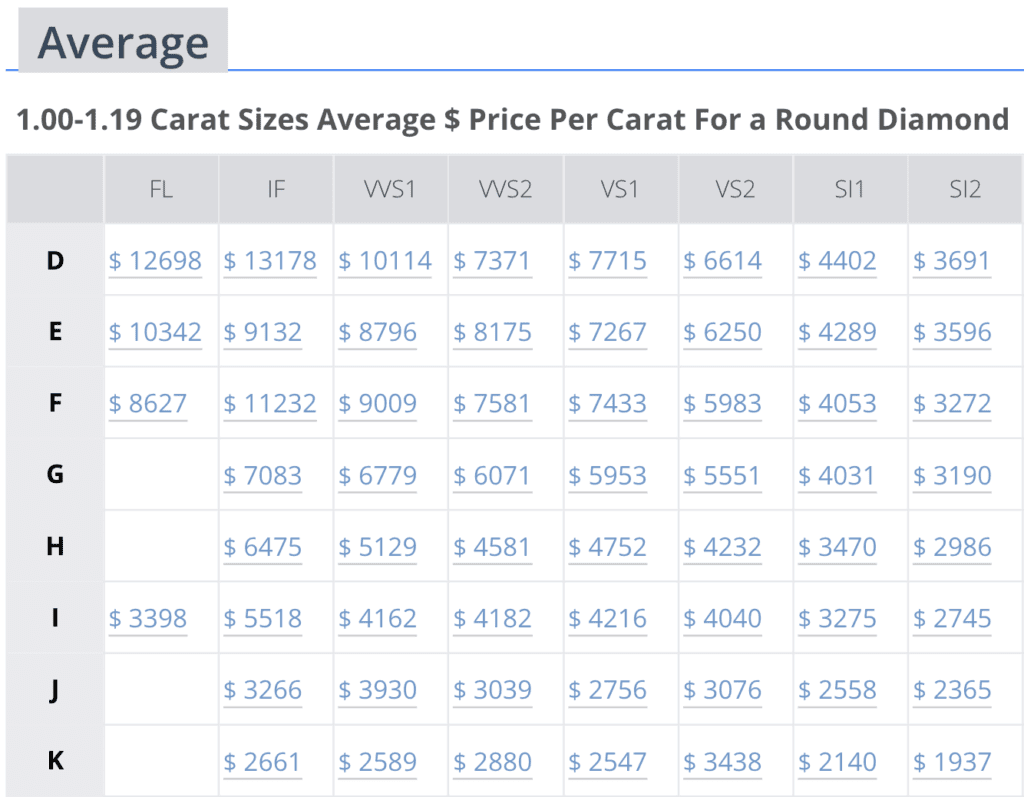

August pricing reflects stability in premium-grade diamonds, selective demand across mid-tier categories, and early indications of stability in lower-grade goods. As lab-grown diamonds reshape the broader market, natural diamonds continue to show differentiated performance by clarity and color tier.

Premium Grades

Top-end stones remained stable. D/FL decreased slightly from $12,840 to $12,698, while D/IF recorded a minor adjustment to $13,178, holding firm above $13,000. E/FL declined to $10,342, and E/IF eased to $9,132, both still within expected margins. F/IF sustained its upward shift from July, closing at $11,232.

Demand in this category remains consistent, driven by rarity, investor confidence, and long-term value retention.

Mid-Range Grades

Movement across the mid-tier was mixed. F/VVS1 increased to $9,009, building on last month’s momentum. E/VVS2 rose to $8,175, while F/VS1 advanced to $7,433. G/VS2 declined slightly to $5,551, and H/VS2 was largely flat at $4,232.

This price activity reflects careful buying. Consumers in this segment continue to evaluate price-to-appearance value, often cross-referencing against premium lab-grown options.

Lower Grades

Some improvement was noted in select lower-grade pairings. I/SI1 increased to $3,275, up from $3,221. K/SI2 ticked up to $1,937, and J/SI1 rose to $2,558. H/SI1 and G/SI2 showed little movement.

Entry-level diamonds remain price-sensitive, but targeted demand at specific clarity/price intersections is emerging.

Market Implications

August trends reinforce a tiered market structure. Premium goods remain stable and in demand. Mid-range stones continue to trade within a tighter value band, while lower grades may be approaching a floor. Continued segmentation will be critical as natural diamonds navigate value positioning in a lab-grown-influenced market.

Popular Diamond Shapes