How Are Diamonds Made? Natural vs Lab-Created Explained

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

Where can I buy loose lab-grown diamonds? Shop loose lab-grown diamonds at PriceScope. Featuring premium quality lab-grown diamonds at Whiteflash, James Allen, Blue Nile, Adiamor, B2C Jewels, and more.

Click any cell in the table to see 12 different size categories and 12 different shape prices searchable by color and clarity.

The lab-grown diamond market in June 2025 continued to reflect dynamic pricing trends across clarity and color categories, influenced by seasonal shifts in consumer behavior, evolving demand for specific qualities, and steady supply-side activity. Below is a detailed comparison of changes between May and June 2025.

In the premium segment, flawless (FL) diamonds saw a noticeable price increase, rising from $844 in May to $929 in June. This upward movement suggests renewed interest in top-tier clarity diamonds, likely driven by high-end engagement ring buyers or collectors. Internally flawless (IF) diamonds followed a similar trend, increasing from $626 to $668, underscoring their steady appeal as an accessible premium option. This marks a continued upward momentum in premium-grade pricing.

Mid-tier clarity grades presented consistent growth. D/VVS1 diamonds rose from $597 to $683, while G/VVS2 moved up from $485 to $542. These increases emphasize the growing popularity of diamonds offering high clarity without the premium cost of FL or IF grades. The pricing shifts in this range highlight buyer behavior that leans toward quality and value. Particularly among those purchasing for milestone occasions.

Our analysis of the Top 5 Popular Lab-Grown Diamond Shapes from May to June 2025:

This June 2025, round-cut diamonds remain the leading lab-grown diamond shape, holding 51.34% of the market. While they continue to dominate, this reflects a slight dip from May’s 51.97%, which may indicate a gradual shift as consumers show growing interest in alternative shapes.

Oval-cut lab-grown diamonds gain significant traction, rising from 10.24% in May to 12.82% in June. This sharp increase positions the oval shape as the fastest-rising preference this month, likely driven by its elegant appearance and flattering proportions.

Cushion-cut diamonds decrease in popularity, falling from 10.83% to 8.44%, suggesting that May’s growth may have been temporary. Emerald-cut diamonds also continue to decline, moving from 9.12% to 7.51%, reflecting a reduced interest in step-cut styles in favor of more brilliant options.

Radiant-cut lab-grown diamonds experience a minor drop from 6.92% in May to 6.82% in June, indicating steady interest from buyers who value both brilliance and structure.

Join the world’s leading diamond and jewelry forum and stay informed with PriceScope’s monthly Lab-Grown Diamond Price Analysis. Each edition brings up-to-date market trends across 12 shape and carat categories. Whether you’re a buyer, seller, or industry observer, our report offers reliable data and transparent insights into today’s lab-grown diamond market.

Stay informed. Stay competitive. Only at PriceScope.

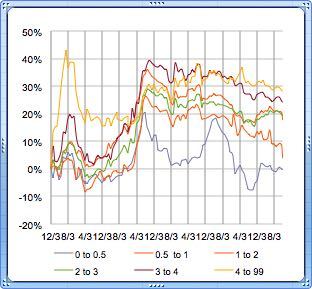

Retail Diamond Prices Chart Updated Monthly.

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

A Wedding Ring as Unique as Your Love Finding the right wedding ring isn’t just about diamonds or gold – it’s about finding the one that feels right. With hundreds…

So, you’re thinking about lab-grown diamonds? Smart move. They’re just as sparkly as the natural kind but usually cost less. But where do you actually go to buy them? It…

Want to stay updated on the most recent blogs, forum posts, and educational articles? Sign up for Bling News, PriceScope’s weekly newsletter.