How Are Diamonds Made? Natural vs Lab-Created Explained

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

Where can I buy loose diamonds? Shop over 437,378 loose natural diamonds at PriceScope. Featuring premium natural diamonds from the likes of Whiteflash, James Allen, Blue Nile, Adiamor, B2C Jewels, and more.

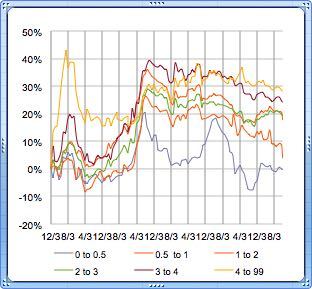

| ROUND Natural Diamond Price Changes For The Last 3 months | |||

| Diamond Carat Sizes | 4/1/2025 | 5/1/2025 | 6/1/2025 |

| 0.0 – 0.5 | 1 % ↑ | 3 % ↑ | 0 % |

| 0.5 – 1.0 | 0 % | 5 % ↑ | -2 % ↓ |

| 1.0 – 2.0 | 1 % ↑ | 3 % ↑ | -1 % ↓ |

| 2.0 – 3.0 | 0 % | 2 % ↑ | 0 % |

| 3.0 – 4.0 | 0 % | 2 % ↑ | -1 % ↓ |

| 4.0 – 99 | -1 % ↓ | 2 % ↑ | -1 % ↓ |

The delayed and contested U.S. tariffs, initially applied April 5, then adjusted through appeals, continue to hamper trade flow and add unpredictability. Major diamond centers (Belgium, India, Israel) remain on high alert, adjusting export volumes and inventory levels in response to shifting tariff timelines.

Click any cell in the table to see 12 different size categories and 12 different shape prices searchable by color and clarity.

The natural diamond market in May 2025 showcased diverse pricing trends across clarity and color categories, shaped by evolving consumer preferences and intensified competition from lab-grown diamonds. This month’s insights highlight a dynamic environment, presenting both opportunities and challenges across premium, mid-range, and budget-friendly diamond grades.

Premium diamonds experienced mixed price movements in June. D/FL clarity diamonds dipped slightly from $13,218 in May to $12,586, while D/IF clarity strengthened to $13,224 from $12,964, reflecting selective demand for internally flawless stones. E/FL clarity remained unchanged at $10,786, suggesting market stabilization. Meanwhile, F/VVS1 diamonds advanced to $8,611 from $8,539, hinting at a gradual uptick in consumer confidence in premium categories.

The mid-range segment continued to see steady interest with slight variations. H/VS1 clarity diamonds rose to $4,759 from $4,755, maintaining their attractiveness among buyers seeking quality within budget. However, F/VVS2 diamonds slipped slightly to $7,560 from $7,349, indicating nuanced shifts in preferences within this category.

Lower-grade diamonds faced mixed pressures. J/SI1 diamonds decreased slightly to $2,550 from $2,570, while K/SI2 diamonds decreased slightly to $1,834 from $1,897. I/SI1 diamonds saw a marginal rise to $3,349 from $3,251, underscoring ongoing challenges within this segment but some signs of resilience as price pressures ease.

June’s trends reveal a slight drop in the top-end D/FL category and resilience in D/IF diamonds, with mid-range diamonds holding firm. Lower-grade diamonds continue to grapple with price pressures but show tentative signs of recovery. Retailers and wholesalers can capitalize on these patterns by adapting marketing strategies and inventory mixes to meet shifting consumer needs, particularly with lab-grown competition intensifying in lower and mid-range categories.

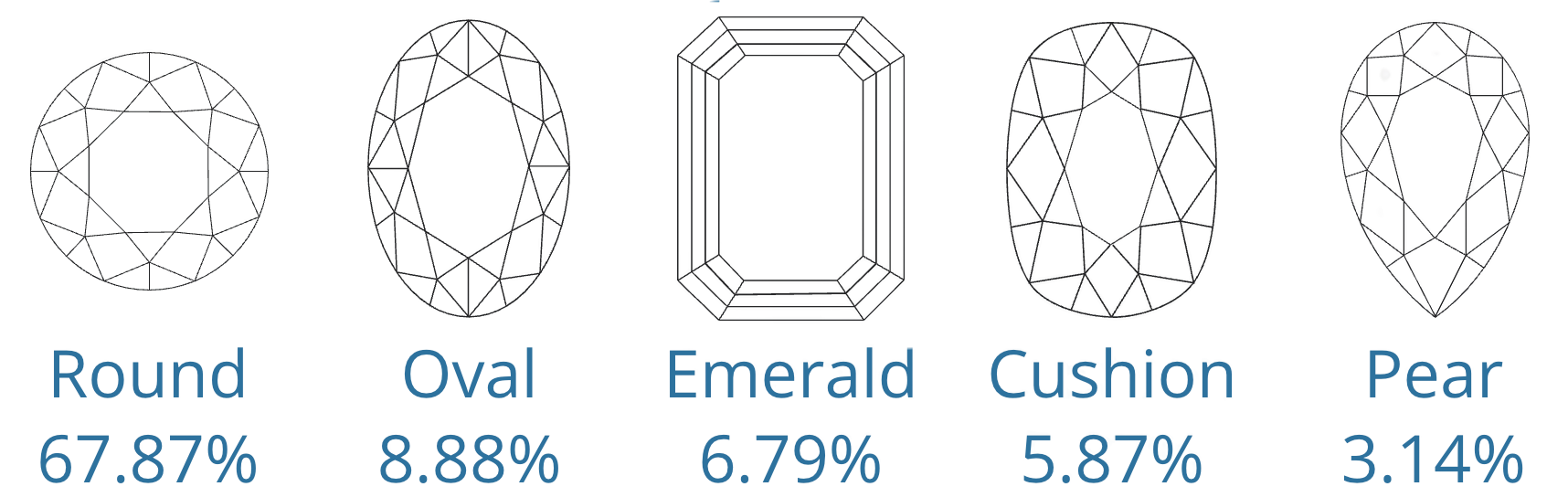

In our latest analysis of the Top 5 Popular Natural Diamond Shapes from May to June 2025, the natural diamond market revealed evolving consumer preferences, reflecting both stability in classic shapes and shifts within alternative cuts.

Round diamonds further solidified their dominance, rising from 62.44% in May to 67.87% in June (+5.43%), highlighting their continued appeal for timeless, versatile engagement ring designs. Despite this gain, Oval diamonds declined from 10.91% to 8.88% (-2.03%), signaling a slight softening in demand for elongated, modern shapes.

Emerald diamonds experienced a modest rise, increasing from 6.08% to 6.79% (+0.71%), reflecting sustained interest in elegant, clean lines. Cushion diamonds also rebounded slightly, moving from 4.92% to 5.87% (+0.95%), suggesting a renewed appreciation for softly rounded, classic designs.

Pear-shaped diamonds, however, saw a notable drop from 6.45% to 3.14% (-3.31%), indicating a declining demand for this distinctive teardrop shape in the current market landscape.

June 2025 trends highlight the enduring popularity of Round diamonds and a stabilizing interest in Emerald and Cushion shapes. The decline in Pear-shaped and Oval diamonds suggests a nuanced shift in consumer tastes, with some favoring traditional cuts over bold, modern shapes. Retailers can use these insights to improve inventory strategies and better align marketing efforts with evolving consumer preferences.

As June 2025 unfolds, the natural diamond market reflects a clear preference for round cuts and internal clarity in premium tiers, with mid and lower segments navigating headwinds from softened demand and lab-grown alternatives. A volatile tariff backdrop adds to the complexity. Vendors should adopt agile pricing models, shape-centric inventory strategies, and leverage consumer-oriented policies to retain market relevance and growth.

PriceScope provides monthly updates and detailed insights through our Diamond Price Chart pages, covering both natural and lab-grown diamond pricing to help you navigate the evolving diamond industry effectively.

Retail Diamond Prices Chart Updated Monthly.

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

A Wedding Ring as Unique as Your Love Finding the right wedding ring isn’t just about diamonds or gold – it’s about finding the one that feels right. With hundreds…

So, you’re thinking about lab-grown diamonds? Smart move. They’re just as sparkly as the natural kind but usually cost less. But where do you actually go to buy them? It…

Want to stay updated on the most recent blogs, forum posts, and educational articles? Sign up for Bling News, PriceScope’s weekly newsletter.