Where can I buy loose diamonds? Shop over 437,378 loose natural diamonds at PriceScope. Featuring premium natural diamonds from the likes of Whiteflash, James Allen, Blue Nile, Adiamor, B2C Jewels, and more.

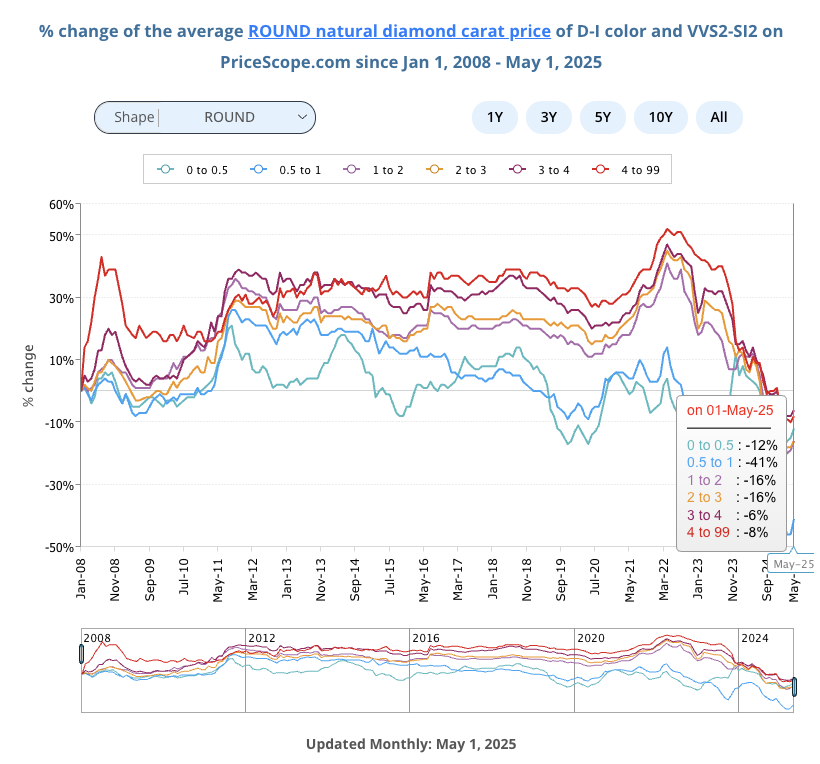

Round Diamond Price Chart

| ROUND Natural Diamond Price Changes For The Last 3 months | |||

| Diamond Carat Sizes | 3/1/2025 | 4/1/2025 | 5/1/2025 |

| 0.0 – 0.5 | 2 % ↑ | 1 % ↑ | 3 % ↑ |

| 0.5 – 1.0 | -3 % ↓ | 0 % | 5 % ↑ |

| 1.0 – 2.0 | -3 % ↓ | 1 % ↑ | 3 % ↑ |

| 2.0 – 3.0 | 1 % ↑ | 0 % | 2 % ↑ |

| 3.0 – 4.0 | -1 % ↓ | 0 % | 2 % ↑ |

| 4.0 – 99 | 1 % ↑ | -1 % ↓ | 2 % ↑ |

In April 2025, the natural diamond market exhibited cautious optimism, with the RapNet Diamond Index (RAPI™) for 1-carat diamonds increasing by 0.4%. This modest rise follows a 1.4% gain in March, signaling a gradual recovery driven by steady demand and limited polished inventories.

However, the recent imposition of U.S. tariffs has introduced significant uncertainty into the diamond industry. Effective April 5, a baseline tariff of 10% was applied to all diamond imports into the United States. Subsequently, on April 9, higher reciprocal tariffs were implemented, with India facing a 27% tariff on its diamond exports. Given that India processes over 80% of the world’s diamonds, this development poses a substantial challenge to the global supply chain.

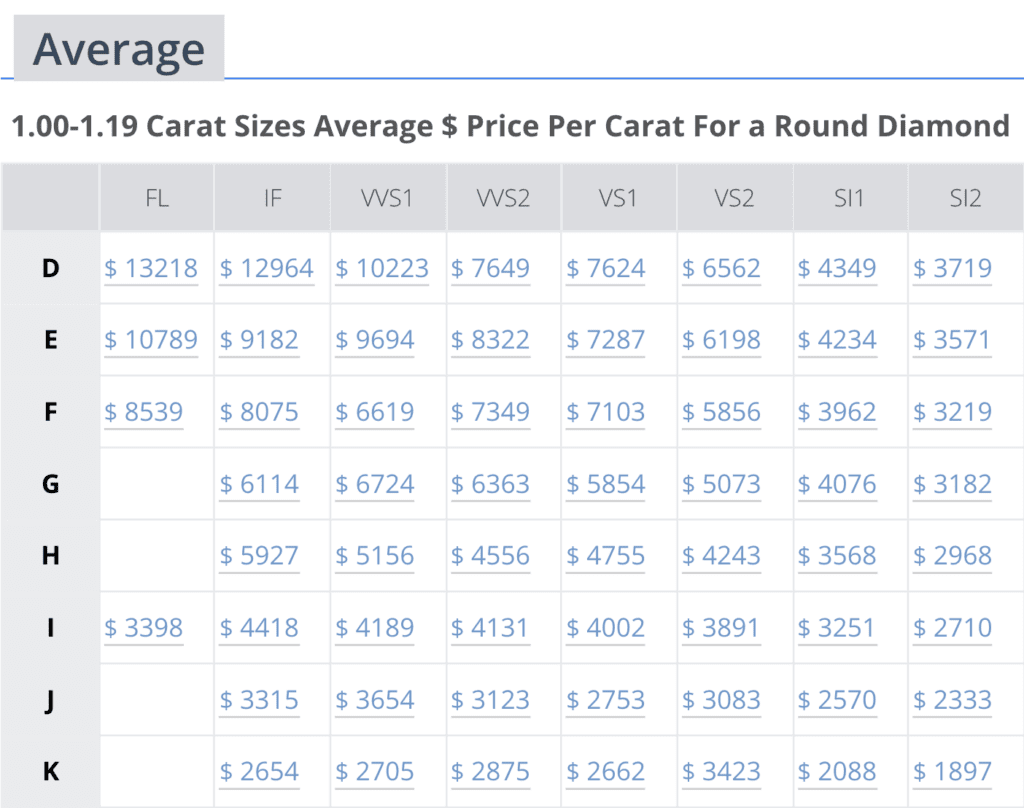

Average Price Per Carat For a Round Diamond

Click any cell in the table to see 12 different size categories and 12 different shape prices searchable by color and clarity.

The natural diamond market in May 2025 revealed significant pricing trends across clarity and color categories, driven by evolving consumer preferences, intensified competition from lab-grown diamonds, and shifting market conditions. This month’s insights highlight a complex environment, presenting both opportunities and challenges across premium, mid-range, and budget-friendly diamond grades.

Premium Grades

Premium diamonds saw mixed results in May. D/FL clarity diamonds rose significantly from $12,353 in April to $13,218, signaling strong demand for flawless stones. D/IF clarity also improved slightly, moving to $12,964 from $12,472. However, E/FL clarity diamonds showed modest growth, increasing just $115 to $10,789. F/VVS1 diamonds rebounded from their previous dip, rising to $8,539 from $8,326. These trends suggest selective consumer interest, with flawless and near-flawless categories performing well.

Mid-Range Grades

The mid-range market showed steady performance. G/VVS2 diamonds increased slightly from $6,191 to $6,363, while H/VS1 clarity stones recovered to $4,755 from $4,509. F/VVS2 diamonds, however, dipped marginally to $7,349 from $7,153. Overall, this segment continues to attract value-focused buyers, with stable demand for popular clarity and color combinations.

Lower Grades

Lower-tier diamonds remain under pressure but showed slight recovery in some areas. J/SI1 diamonds rose to $2,333 from $2,233, and K/SI2 diamonds edged up to $1,897 from $1,888. However, I/SI1 diamonds declined slightly to $3,251, reflecting ongoing challenges in this segment, particularly from competition with lab-grown diamonds.

Market Implications

May’s trends highlight selective growth in premium categories and stability in mid-range grades, offering opportunities for retailers to focus on targeted marketing and inventory strategies. Lower-grade diamonds continue to face challenges, emphasizing the need to diversify offerings with lab-grown or value-focused options to meet shifting consumer preferences.

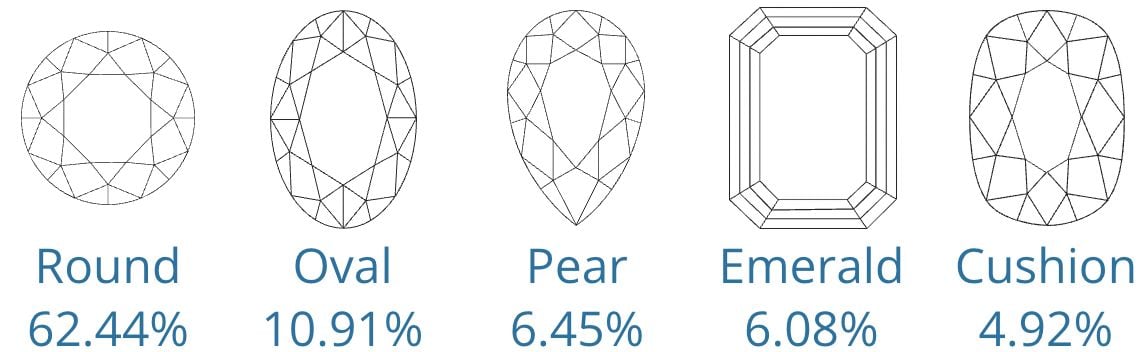

Popular Diamond Shapes

In our latest analysis of the Top 5 Popular Natural Diamond Shapes from April to May 2025, the natural diamond market revealed significant shifts in shape preferences, reflecting evolving consumer behavior.

Round diamonds strengthened their dominance, increasing from 51.97% to 62.44% (+10.47%), driven by their brilliance and versatility. Oval diamonds rose from third to second place, with a modest increase from 10.24% to 10.91% (+0.67%), maintaining their appeal for modern designs. Pear-shaped diamonds entered the Top 5 in May at 6.45%, reflecting growing demand for distinctive and bold shapes.

Emerald diamonds declined from 9.12% to 6.08% (-3.04%), while Cushion diamonds experienced the largest drop, falling from 10.83% to 4.92% (-5.91%), signaling a shift away from traditional, vintage-inspired designs.

Market Implications

May 2025 trends highlight a strong preference for classic shapes like Round diamonds and the growing popularity of modern, elongated designs such as Oval and Pear cuts. Declines in Emerald and Cushion shapes suggest evolving consumer preferences toward more contemporary aesthetics.

Bottom Line

As May 2025 begins, the natural diamond market continues to experience evolving consumer preferences and intensifying competition from lab-grown diamonds. Premium diamonds, particularly in the D/IF and D/FL clarity grades, remain strong, reflecting consistent demand for high-quality stones. Concurrently, increasing consumer interest in elongated and mid-range diamond shapes indicates further diversification of buying patterns. Retailers and industry professionals should closely monitor these emerging trends and adjust their strategies proactively to stay relevant and competitive throughout the month ahead.

PriceScope provides monthly updates and detailed insights through our Diamond Price Chart pages, covering both natural and lab-grown diamond pricing to help you navigate the evolving diamond industry effectively.

Latest Publications on Diamond Prices May 2025:

Rapaport

- Market Comment

- ‘Strong Performance’ in Both Lab-Grown and Natural Buoys IGI Revenue

- India’s Polished Diamond Exports Fall to Lowest in 20 Years