xxxxxx

Brilliant_Rock

- Joined

- Jan 6, 2019

- Messages

- 828

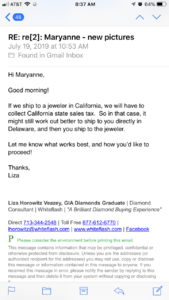

Yes, this is how it is supposed to work. However, if WF is shipping the stone to Cali, they may charge her Cali sales tax.Wouldn't it be the following:

If, for instance you bought a stone from WF, and you live in Ill, then they charge you Illinois sales tax, say they then ship it to Caysie, then Caysie would charge you for the sales tax on the setting (also illinois).

So you'll tax the full amount for Illinois.

Then your required to pay the use tax yourself if they dont charge for it and pay it.Thanks for everybodys expertise. And this is still the case when these vendors are small and probably don't sell more than 100k of goods in Illinois?

Which would be in error. I can see where vendors are going to adopt policies of only shipping to home addresses/states for all payment types. Most if not all credit cards all ready do. That would avoid the possibility of being a party to tax evasion.Yes, this is how it is supposed to work. However, if WF is shipping the stone to Cali, they may charge her Cali sales tax.

Yes, it would be in error. However, it would not be on OP when the company goes through a sales tax audit and ends up having to correct their mistake. I take that back- it would be highly unlikely that the company came back and had OP pay anything additionally.Which would be in error. I can see where vendors are going to adopt policies of only shipping to home addresses/states for all payment types. Most if not all credit cards all ready do. That would avoid the possibility of being a party to tax evasion.

That’s odd to me that the tax would be considered ‘variable’ depending on the shipping address vs. the buyer’s ‘home address’ (even though it may be shipped to FedEx near that buyer’s home).

And in some cases, even though they are in the same vicinity, the tax rate may be slightly different. That's how freaking complicated this is!

It is based upon the requirements of the preponderance of states. Most feel empowered to collect tax on any transactions involving deliveries within their borders.@Texas Leaguer Thanks so much for sharing that! I agree - too often, the ‘what’ is made ‘law’ with little consideration for ‘how’. I feel/see that all too often in my industry.

When you say ‘default trigger=shipping address’, is that based on what was outlined/directed via the SCOTUS ruling? Or is that specific to WF’s accounting software rules complying with the ruling?

It is based upon the requirements of the preponderance of states. Most feel empowered to collect tax on any transactions involving deliveries within their borders.

@the_mother_thing I can tell you what I was told by our parent company's CPA...

Our parent company is located in PA and will purchase IT equipment for us down here in Texas. Half the time our parent company pays PA sales tax on the item (PA sales tax is 6% and Texas is 8.25%). I was told that we are only responsible for remitting the difference of the two tax rates to our state (so 2.25%).

Sorry, I should have clarified- if no PA sales tax was paid, we have to remit the full Texas amount. We just don’t have to pay sales tax twice if PA had already been paid.That makes zero sense to me ... not that I doubt what you’re saying ... just baffling! Why is tax only paid half the time?

About the ONLY ‘good’ thing to come out of this appears to be a huge demand for tax attorneys, accountants & accounting/tax software to help businesses sort it all out as well as help tax payers to stay out of Uncle Sam’s audit crosshairs and/or jail.