- Joined

- Apr 19, 2008

- Messages

- 1,493

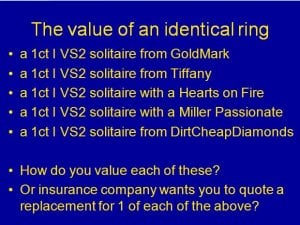

An new arcticle about independent appriasers "What Is An Independent Appraisal and The Benefit In Securing One"

http://journal.pricescope.com/Articles/85/1/What-Is-An-Independent-Appraisal-and-The-Benefit-In-Securing-One.aspx

Thankyou Judah for your contribution.

http://journal.pricescope.com/Articles/85/1/What-Is-An-Independent-Appraisal-and-The-Benefit-In-Securing-One.aspx

Thankyou Judah for your contribution.

300x240.png)