- Joined

- Aug 15, 2000

- Messages

- 19,118

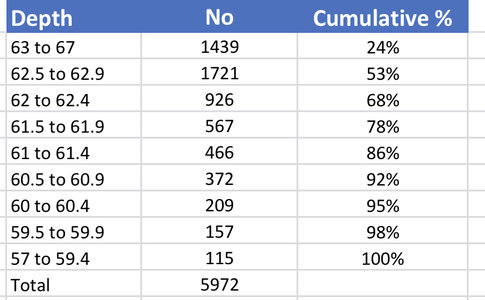

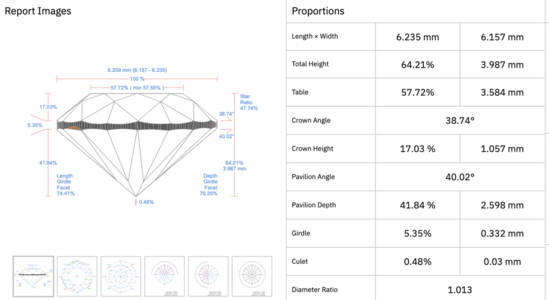

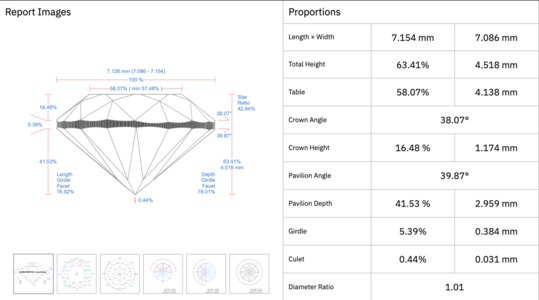

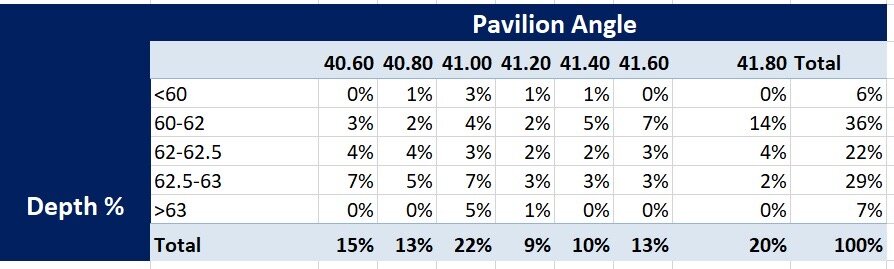

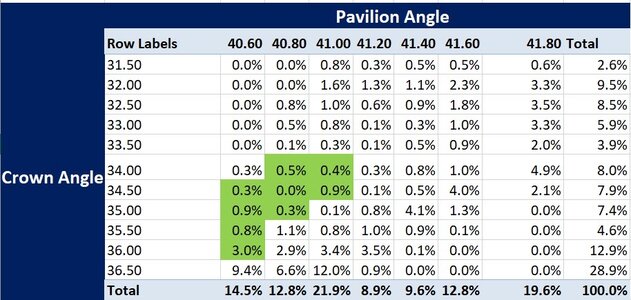

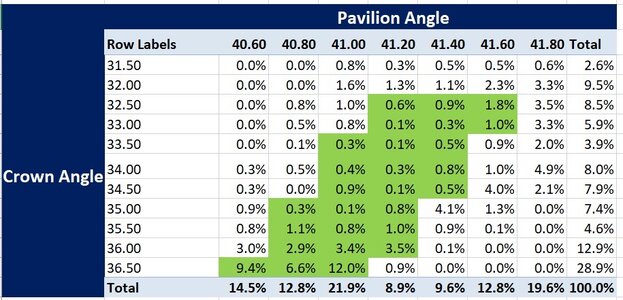

On Rapaport B2B trading platform Sergey. Many companies do not give crown and pavilion angles. So the best I can do is show with depth %'s.Garry, where do you buy diamonds if you mainly see natural diamonds with Pavilion 41.7 /crown35.0?

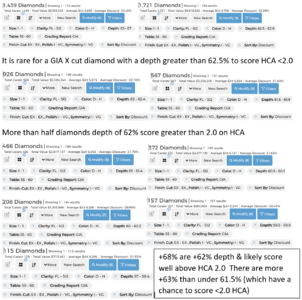

+68% are +62% depth & likely score well above HCA 2.0

There are more +63% than under 61.5% (which have a chance to score <2.0 HCA)

300x240.png)