You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ACA Premium

- Thread starter ALRAAA

- Start date

- Status

- Not open for further replies. Please create a new topic or request for this thread to be opened.

Big Fat Facets

Brilliant_Rock

- Joined

- Jun 7, 2019

- Messages

- 1,468

Hello,

Can anybody please explain why an ACA stone is generally 50% pricier than a similar GIA triple Excellent Stone?

it's super ideal and has MUCH narrower range than that of gia triple x range.

gia triple x range is actually rather broad in comparison to the super ideal of whiteflash aca or cbi/hpd or gavin signature or canera h&a.

- Joined

- Jul 31, 2014

- Messages

- 20,123

You are paying for the guarantee of getting an ideal (AGS 000) stone, customer service, and a $1 upgrade policy.Is one paying for the curation or does the cutting take significantly longer?

Big Fat Facets

Brilliant_Rock

- Joined

- Jun 7, 2019

- Messages

- 1,468

Is one paying for the curation or does the cutting take significantly longer?

hmm, the cutting is much more exacting and stringent. so deductively, requires more skill. additionally, they are cut for beauty and optimal light performance rather than weight retention which i understand often occurs. furthermore, they are branded cuts with desirable trade in/trade up, buy back policies (most notable are aca and cbi) which many consider to be an important factor when selecting a diamond.

hmm, the cutting is much more exacting and stringent. so deductively, requires more skill. additionally, they are cut for beauty and optimal light performance rather than weight retention which i understand often occurs. furthermore, they are branded cuts with desirable trade in/trade up, buy back policies (most notable are aca and cbi) which many consider to be an important factor when selecting a diamond.

In general, do you know the market resale value (%) of an ACA diamond? Is such a metric available?

Big Fat Facets

Brilliant_Rock

- Joined

- Jun 7, 2019

- Messages

- 1,468

In general, do you know the market resale value (%) of an ACA diamond? Is such a metric available?

I am afraid, i do not know the market resale value of an ACA diamond.

I have never sold a diamond. I just buy them.

BUT i would absolutely love to know the answer to your question!!!

Im hoping the more seasoned and experienced will chime in to help us!!

Big Fat Facets

Brilliant_Rock

- Joined

- Jun 7, 2019

- Messages

- 1,468

Hello,

Can anybody please explain why an ACA stone is generally 50% pricier than a similar GIA triple Excellent Stone?

Also, wanted to mention that diamonds that are ags (american gem society) triple zero are within a narrower range than gia triple x BUT not as narrow as those brands mentioned. AGS is known to be softer on color though than GIA. So, you do have another option, if paying the premium is unattractive to you.

In general, do you know the market resale value (%) of an ACA diamond? Is such a metric available?

High Performance Diamonds ( CBI ) has a lifetime buy back policy of 80 % for super ideal diamonds which is amazing. Typically for a non branded GIA triple X diamond you can lose up to 50 % for resale. Not sure about whiteflash buy back policy.

- Joined

- Jan 2, 2017

- Messages

- 1,851

High Performance Diamonds ( CBI ) has a lifetime buy back policy of 80 % for super ideal diamonds which is amazing. Typically for a non branded GIA triple X diamond you can lose up to 50 % for resale. Not sure about whiteflash buy back policy.

Whiteflash buyback policy is here:

https://www.whiteflash.com/confidence/one-year-buy-back-guarantee/

70% of rrp up to 1 year from purchase.

- Joined

- Jan 2, 2017

- Messages

- 1,851

@ALRAAA , there are a number of factors. Yes you do pay a premium for a branded super ideal, but that premium is nothing compared against purchasing a stone with similar colour clarity and carat combinations from one of the big jewellery houses.

Now, with that out of the way, as with any diamond, your retail price is influenced by the price of diamond rough, cost of planning how to cut (and in the case of super ideals, the cutter is usually trying to ensure precision of facet placement and optical symmetry) and cost of how much rough is lost in the cutting process (typically, diamonds with super ideal proportions will “lose” more rough than those with typical GIA XXX proportions).

A large number of cutters target weight retention over cut precision and beauty. As such, they usually will cut to ensure that stones are on the edge of the GIA XXX range. When they do that, a large number of stones will suffer from bad light performance over a super ideal. As for the cutter, they will make more money from a GIA XXX that just squeezes over the magic carat mark (e.g. 1/2/3 cts) rather than cutting a stone for beauty that is under that magic carat mark.

Now, with that out of the way, as with any diamond, your retail price is influenced by the price of diamond rough, cost of planning how to cut (and in the case of super ideals, the cutter is usually trying to ensure precision of facet placement and optical symmetry) and cost of how much rough is lost in the cutting process (typically, diamonds with super ideal proportions will “lose” more rough than those with typical GIA XXX proportions).

A large number of cutters target weight retention over cut precision and beauty. As such, they usually will cut to ensure that stones are on the edge of the GIA XXX range. When they do that, a large number of stones will suffer from bad light performance over a super ideal. As for the cutter, they will make more money from a GIA XXX that just squeezes over the magic carat mark (e.g. 1/2/3 cts) rather than cutting a stone for beauty that is under that magic carat mark.

- Joined

- Apr 3, 2004

- Messages

- 33,852

Where did you get the idea of 50% pricer?Hello,

Can anybody please explain why an ACA stone is generally 50% pricier than a similar GIA triple Excellent Stone?

- Joined

- Jul 31, 2014

- Messages

- 20,123

This. It's definitely not 50%. Not even close.Where did you get the idea of 50% pricer?. AFAIK more like 10-12%. You must compare orange vs orange like true H&A and its cut quality. Most GIA XXX aren't top ideal cuts. Yes, there are GIA XXX H&A super ideal cut stones out there, but you must do more homework of finding them.

- Joined

- Apr 3, 2004

- Messages

- 33,852

Yup, no other vendors can beat CBI's cash buy back policy of 80%.High Performance Diamonds ( CBI ) has a lifetime buy back policy of 80 % for super ideal diamonds which is amazing. Typically for a non branded GIA triple X diamond you can lose up to 50 % for resale. Not sure about whiteflash buy back policy.

- Joined

- Mar 2, 2013

- Messages

- 6,328

If you aren’t keen on paying for a branded label (it’s not 50% more though), and you like WF’s benefits, consider their Expert & Premium Selection lines, which I believe carry the same trade-up offer as ACAs (not sure about buy-back though). These are also quality diamonds that are in-house and can be vetted by WF staff for you; and the ES line usually has diamonds that just narrowly miss ACA branding, and as such are a great value. My avatar pic is an ES and it’s outstanding, IMO.

HPD has a 2.5 carat, D colored, VS1, selling for $80K right now.

https://www.hpdiamonds.com/en-us/diamonddetail/HPD10783

I just searched rarecarat - a diamond with similar characteristics sells in the mid forties.

If that's not a 50% premium... are they really losing that much diamond when they are cutting them? If the light performance that much better? Or is it like somebody spending $400 for flip flops?

This is a bit absurd.

https://www.hpdiamonds.com/en-us/diamonddetail/HPD10783

I just searched rarecarat - a diamond with similar characteristics sells in the mid forties.

If that's not a 50% premium... are they really losing that much diamond when they are cutting them? If the light performance that much better? Or is it like somebody spending $400 for flip flops?

This is a bit absurd.

- Joined

- Mar 2, 2013

- Messages

- 6,328

HPD has a 2.5 carat, D colored, VS1, selling for $80K right now.

https://www.hpdiamonds.com/en-us/diamonddetail/HPD10783

I just searched rarecarat - a diamond with similar characteristics sells in the mid forties.

If that's not a 50% premium... are they really losing that much diamond when they are cutting them? If the light performance that much better? Or is it like somebody spending $400 for flip flops?

This is a bit absurd.

Post the stats from the lab reports for both diamonds, and I bet that while both may be diamonds, they are NOT both ‘apples’.

- Joined

- Jun 23, 2005

- Messages

- 18,133

Seeing is believing but only you can decide. As with most things, you get what you pay for. A 2.5 carat, D, VS1, for 40k tells me that it would be far below the HPD diamond in terms of light performance. If it was on par, the pricing would be as well. You have to compare apples to apples - not just in terms of color, clarity and price. There really are no bargains in diamonds - again, as I said, you get what you pay for.

You could also go down in size to balance out the pricing as well. Just make sure that you choose a vendor with a great trade in policy. You may think she will never want to do that but you'd be surprised what time can do.

You could also go down in size to balance out the pricing as well. Just make sure that you choose a vendor with a great trade in policy. You may think she will never want to do that but you'd be surprised what time can do.

- Joined

- Jul 31, 2014

- Messages

- 20,123

What do you mean by "similar characteristics"? If you mean same size/color/clarity, you are missing the most important part of why anyone purchases a CBI: cut. I am confident that if you find a stone with similar proportions/cut AND the same color/size/clarity then the prices will be much more similar. There is a premium for super ideals, but it's not 50%HPD has a 2.5 carat, D colored, VS1, selling for $80K right now.

https://www.hpdiamonds.com/en-us/diamonddetail/HPD10783

I just searched rarecarat - a diamond with similar characteristics sells in the mid forties.

If that's not a 50% premium... are they really losing that much diamond when they are cutting them? If the light performance that much better? Or is it like somebody spending $400 for flip flops?

This is a bit absurd.

- Joined

- Dec 3, 2011

- Messages

- 10,051

@ALRAAA, if you could forget D and consider an F you'd get WAAAAAY more for your money... and it would still be in the colorless range.

Actually, I think G would afford you a VERY white diamond for much, much less. It will be white.

Actually, I think G would afford you a VERY white diamond for much, much less. It will be white.

- Joined

- Jan 2, 2017

- Messages

- 1,851

Post the stats from the lab reports for both diamonds, and I bet that while both may be diamonds, they are NOT both ‘apples’.

I just went down that rabbit hole and used RC to find a 2.5ct D VS1 for around $40k.

This one showed up at With Clarity:

https://www.withclarity.com/diamond/719403166?utm_source=rarecarat&utm_medium=cpc

GIA report is as follows:

What does the stone look like?

Actual crown-pavilion angle combo on this is likely to be 34.1-34.2/40.7. I look at the video on the listing and notice that it looks very hazy as it rotates around. GIA comments that additional pinpoints are not shown. One wonders if there are a lot more microscopic inclusions that are visible at greater magnifications than 10x that are causing the haziness.

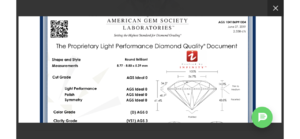

The CBI stone posted by @ALRAAA has no imagery available currently (suspect images are being done at GCAL now). The AGS report however shows this:

Y’all be the judge. I however am off to bed now (insomnia has kicked in for me now at close to 1am).

Last edited:

- Joined

- Dec 3, 2011

- Messages

- 10,051

- Joined

- Dec 3, 2011

- Messages

- 10,051

HPD has a 2.5 carat, D colored, VS1, selling for $80K right now.

https://www.hpdiamonds.com/en-us/diamonddetail/HPD10783

I just searched rarecarat - a diamond with similar characteristics sells in the mid forties.

If that's not a 50% premium... are they really losing that much diamond when they are cutting them? If the light performance that much better? Or is it like somebody spending $400 for flip flops?

This is a bit absurd.

Some will not be able to tell the difference in a super ideal vs a very well cut stone... so they obviously don't want to pay the premium (although I don't believe it to be more than 15%). You may be one of those people, and there is nothing wrong with that! I think I may be one as well - HA! If I wanted to get in with WF for their upgrade program, I would choose an Expert Selection diamond that narrowly missed the mark for ACA, but also doesn't carry the premium. No-brainer for this one!

Last edited:

- Joined

- Mar 13, 2018

- Messages

- 313

- Joined

- May 14, 2010

- Messages

- 4,333

That HPD Diamond is “being crafted” and is on hold. Somebody liked it.

That particular diamond is a CTO (cut to order) so yes it’s pre-sold. That’s exactly what the buyer wants so it’s a special cut diamond to her specifics!

- Joined

- Apr 8, 2017

- Messages

- 2,009

Where are you seeing it's a cut to order diamond? All I can see on the website is that it's currently being cut and is on hold.That particular diamond is a CTO (cut to order) so yes it’s pre-sold. That’s exactly what the buyer wants so it’s a special cut diamond to her specifics!

- Joined

- May 14, 2010

- Messages

- 4,333

I received the video of my diamond from CBI/HPD! Of course this makes waiting even more difficult.

I still haven't finalized the setting design. I'll feel so much better when it is signed off on and in production.

If I’m not mistaken it’s @RunningwithScissors.

It may be another but I suspect not. Even their CTO diamonds are listed on the inventory list.

- Joined

- Mar 2, 2013

- Messages

- 6,328

Not ‘discounting’ the WC diamond (but FYI @ALRAAA if you really do want to buy THAT exact diamond on WC, might as well go to B2C and save another $1K) but there are several other factors not noted that are not being considered beyond “both are D color VS2 clarity diamonds”.

1) GIA rounds diamond parameters, whereas AGS (I believe) does not. So while - per the GIA report - the WC diamond scores a 1.1 on HCA and its GIA report notes specs that are in ideal range, that does not mean it is an ideal (or super-ideal) cut diamond, which the CBI is. So again, while I might not personally kick it out of bed, I cannot - in my mind - put it on the same level as the CBI without true apples-to-apples data to compare in order to say “yes, these two diamonds are on the exact same level playing field and there is a true, significant price discrepancy”. But to @msop04 point, not everyone needs a super-ideal/ideal cut diamond. Some folks are perfectly happy with & love their GIA XXX diamonds (some of which are likely in the ideal range), and that is perfectly fine.

2) The value proposition of the vendor offering the diamond. This is another factor that weighs into the purchase price (the benefits you get from the vendor), which MANY on here place a significant value on. None of this may matter to you, but for a diamond purchase in this price range, it surely should bear due consideration.

- Ask WC (or B2C) if they offer the 80% lifetime buyback policy, if their trade-up policy is as customer-friendly/flexible as HPD (it’s not, I promise). So if/when you decide to upgrade that diamond for an anniversary down the road - assuming the vendor is still in business - prepare to spend probably twice the original price with them to upgrade, if they even have an upgrade policy.

- And to the point of vendor longevity ... do you know how long that vendor has been in business? How reputable are they? Is their business model sustainable that they stand a good chance of being in business when you’re ready to leverage that upgrade policy? Any chance they have/are affiliated with shady industry practices? Note: I am NOT suggesting WC or B2C are, but after the recent “Enchanted Diamonds” debacle, I would be VERY cautious about any dealer I buy from and give my money to ... especially when we’re talking these sorts of budgets!

Okay, so the business checks out & generally seems ‘okay’ ...

- In a time crunch at all? See how long it takes them to provide you with additional imaging (if they even provide it) so you can assess light performance, decide, and show the intended recipient those pretty hearts & arrows. HPD diamond images (not ‘in production’) are readily available to you up front; no waiting.

- What, they don’t provide images at all? Well surely they will send you a loupe, ASET & Ideal scopes free of charge so you can assess the diamond yourself in person and have full confidence in your decision. What, they don’t/won’t? Guess who does ...

- Got the ASET/IS images from the vendor and they check out okay? Great, place your order & wait to see if that diamond is actually even available several days after you pay for it (virtual inventory diamonds are frequently already sold, and the vendors listing them do not always update their websites in a timely manner to let you know this). And if it’s not already sold, see how long it takes you to get that diamond in hand if it’s not literally in that vendor’s hands at that moment. It’s probably coming from overseas, which can take a week or more to get to them depending on what holidays are observed in that country, any customs issues, etc., then they have to inspect/QC it, and send it to you. Not the case for CBIs from what I’ve read from HPD buyers on here.

- Got the diamond? Love it? Great, now consider the quality of the custom setting that vendor makes for you, if they can produce those sexy claw prongs you crave, or do they possess the skill necessary to create a micropave setting that doesn’t ditch diamonds every time you wash your hands. Also, be sure to inquire about their benchwork warranty.

- Got the diamond? Don’t love it? Well, hopefully their return process is at no cost to you, and your payment is quickly refunded/returned after they receive & inspect the diamond. So you can get on with starting your search alllllllll over again.

OP - It’s your money. You worked for it, you know what you want/need, what your priorities are (or perhaps still working those out), what you’re comfortable with, and hopefully what the intended recipient wants/likes, etc. None of us can nor should tell you any of those things. What we can tell you is what we have individually experienced with vendors, what others (like you) have come on here and asked about or experienced (and point you to those threads), help you know what to look for in a good diamond, help you to learn to read the images provided by vendors, the differences between various labs & their reports, and we can tell you that when considering a diamond purchase, there is more to factor in than just the “four Cs” and the price tag. That’s what I’ve tried to do above. At the end of the day, none of those things may matter to you, and that is a-okay; but at least I feel like I’ve done my part to suggest important considerations you might factor into your decision when you write the check/swipe the card/wire the funds.

1) GIA rounds diamond parameters, whereas AGS (I believe) does not. So while - per the GIA report - the WC diamond scores a 1.1 on HCA and its GIA report notes specs that are in ideal range, that does not mean it is an ideal (or super-ideal) cut diamond, which the CBI is. So again, while I might not personally kick it out of bed, I cannot - in my mind - put it on the same level as the CBI without true apples-to-apples data to compare in order to say “yes, these two diamonds are on the exact same level playing field and there is a true, significant price discrepancy”. But to @msop04 point, not everyone needs a super-ideal/ideal cut diamond. Some folks are perfectly happy with & love their GIA XXX diamonds (some of which are likely in the ideal range), and that is perfectly fine.

2) The value proposition of the vendor offering the diamond. This is another factor that weighs into the purchase price (the benefits you get from the vendor), which MANY on here place a significant value on. None of this may matter to you, but for a diamond purchase in this price range, it surely should bear due consideration.

- Ask WC (or B2C) if they offer the 80% lifetime buyback policy, if their trade-up policy is as customer-friendly/flexible as HPD (it’s not, I promise). So if/when you decide to upgrade that diamond for an anniversary down the road - assuming the vendor is still in business - prepare to spend probably twice the original price with them to upgrade, if they even have an upgrade policy.

- And to the point of vendor longevity ... do you know how long that vendor has been in business? How reputable are they? Is their business model sustainable that they stand a good chance of being in business when you’re ready to leverage that upgrade policy? Any chance they have/are affiliated with shady industry practices? Note: I am NOT suggesting WC or B2C are, but after the recent “Enchanted Diamonds” debacle, I would be VERY cautious about any dealer I buy from and give my money to ... especially when we’re talking these sorts of budgets!

Okay, so the business checks out & generally seems ‘okay’ ...

- In a time crunch at all? See how long it takes them to provide you with additional imaging (if they even provide it) so you can assess light performance, decide, and show the intended recipient those pretty hearts & arrows. HPD diamond images (not ‘in production’) are readily available to you up front; no waiting.

- What, they don’t provide images at all? Well surely they will send you a loupe, ASET & Ideal scopes free of charge so you can assess the diamond yourself in person and have full confidence in your decision. What, they don’t/won’t? Guess who does ...

- Got the ASET/IS images from the vendor and they check out okay? Great, place your order & wait to see if that diamond is actually even available several days after you pay for it (virtual inventory diamonds are frequently already sold, and the vendors listing them do not always update their websites in a timely manner to let you know this). And if it’s not already sold, see how long it takes you to get that diamond in hand if it’s not literally in that vendor’s hands at that moment. It’s probably coming from overseas, which can take a week or more to get to them depending on what holidays are observed in that country, any customs issues, etc., then they have to inspect/QC it, and send it to you. Not the case for CBIs from what I’ve read from HPD buyers on here.

- Got the diamond? Love it? Great, now consider the quality of the custom setting that vendor makes for you, if they can produce those sexy claw prongs you crave, or do they possess the skill necessary to create a micropave setting that doesn’t ditch diamonds every time you wash your hands. Also, be sure to inquire about their benchwork warranty.

- Got the diamond? Don’t love it? Well, hopefully their return process is at no cost to you, and your payment is quickly refunded/returned after they receive & inspect the diamond. So you can get on with starting your search alllllllll over again.

OP - It’s your money. You worked for it, you know what you want/need, what your priorities are (or perhaps still working those out), what you’re comfortable with, and hopefully what the intended recipient wants/likes, etc. None of us can nor should tell you any of those things. What we can tell you is what we have individually experienced with vendors, what others (like you) have come on here and asked about or experienced (and point you to those threads), help you know what to look for in a good diamond, help you to learn to read the images provided by vendors, the differences between various labs & their reports, and we can tell you that when considering a diamond purchase, there is more to factor in than just the “four Cs” and the price tag. That’s what I’ve tried to do above. At the end of the day, none of those things may matter to you, and that is a-okay; but at least I feel like I’ve done my part to suggest important considerations you might factor into your decision when you write the check/swipe the card/wire the funds.

- Joined

- Mar 2, 2013

- Messages

- 6,328

Makes sense because 1) a customer may change their mind and the diamond offered for sale; and/or 2) the buyer can view all their CTO diamond details the same way they would otherwise.Even their CTO diamonds are listed on the inventory list.

winnietucker

Ideal_Rock

- Joined

- Jan 4, 2019

- Messages

- 2,921

@the_mother_thing Can’t figure out how to quote you on mobile but so true about the upgrade thing. My center stone is from Zoara. They closed a few months before we were going to upgrade my diamond... And now the upgrade is being delayed further. That sucked.

- Status

- Not open for further replies. Please create a new topic or request for this thread to be opened.

Share:

How Are Diamonds Made? Natural vs Lab-Created Explained How Are Diamonds Made? Natural vs Lab-Created Explained - 08/05

How Are Diamonds Made? Natural vs Lab-Created Explained - 08/05

Top Wedding Ring Brands for Every Style and Budget

Top Wedding Ring Brands for Every Style and Budget - 08/05

Where to Buy Lab Grown Diamonds: Best Places Compared

Where to Buy Lab Grown Diamonds: Best Places Compared - 08/05

300x240.png)