- Joined

- Apr 19, 2008

- Messages

- 1,493

Last edited:

yes please.Do you wish for me to do this on a monthly basis?

Thanks Andrey.

Interesting.

Do you also have access to data on FCDs?

Thanks ... prices.

By color and Argyle, if you got it.

Thanks for all the trouble, Andre.

Be careful @psadmin - you might replace Rap

With all the talk about diamond pricing and what are people thinking. I decided to compare what carat size diamonds consumers are looking at in the last 30 days.

I was surprised to notice that the carat sizes that we consider "Magic" Weights have shifted to higher carats size. See the chart below.

It might be due to price or wishful thinking. Either way, I thought it was interesting.

Since I have been collecting the data 1-carat size was the clear primary magic weight by a margin. This is the first time that 2-carat has taken the lead.

I don't think we can truly make any conclusions, but something to think about.

Yes, but if they are searching a smaller dataset because of listings being removed, and that dataset perhaps contains fewer of the sub-prime sizes, it could increase the percentage of clicks on the magic sizes.If you are talking about carat size click out data graphs, it has nothing to do with Rap as this is what consumers are clicking.

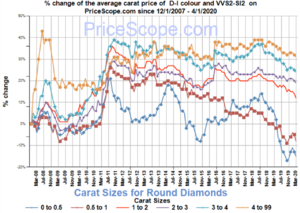

@psadmin Is the diamond price chart based on 2007 pricing?

In other words, is the pricing shown the % increase or decrease since 2007?

From the home page:@psadmin Is the diamond price chart based on 2007 pricing?

In other words, is the pricing shown the % increase or decrease since 2007?

Thank you @psadmin and @Garry H (Cut Nut), now that I have the background, the data for the last three months is more in context and much more understandable.