- Joined

- Jul 27, 2009

- Messages

- 4,169

Is the volatility tied to the war or the lab grown competition?

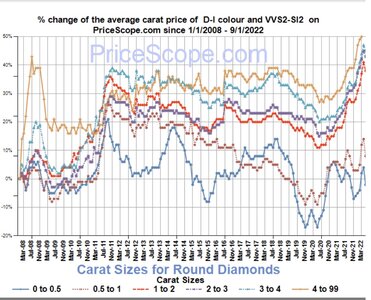

There has been volatility in the market for some time. Macroeconomic forces have had the biggest impacts. The Great Recession is a prime example. Russia's war in Ukraine, coming on the heels of widespread supply chain disruptions due to Covid, is certainly the biggest driver of volatility today.

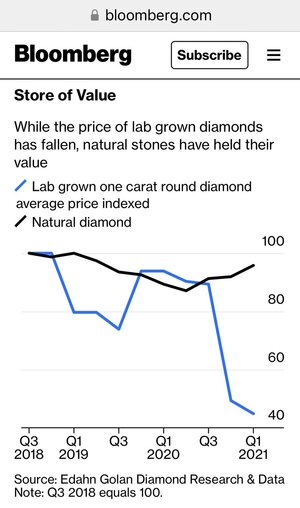

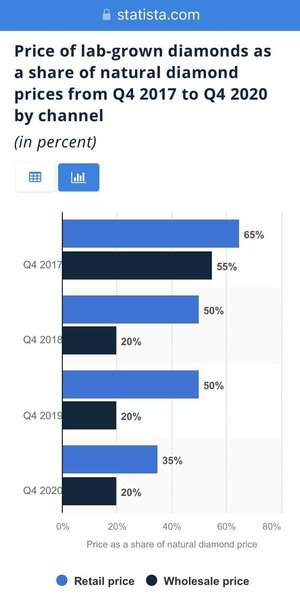

High prices of diamonds and concerns about inflation are currently pushing some consumers in the direction of synthetic diamonds. This is likely to be a transitory time in the market however, as synthetics become more available and continually cheaper.

There are some signs that the war may be entering a phase that will lead to a resolution. Ukraine's recent gains on the battlefield seem to be lifting markets which suggests that many people are expecting things to settle out. It remains to be seen how long sanctions affecting the diamond market will continue to stay in place even after hostilities end however.

Long term, the war will resolve along with supply chain issues, and the market for natural diamonds will likely resume a more predictable trajectory.

300x240.png)