- Joined

- Jun 8, 2009

- Messages

- 21,747

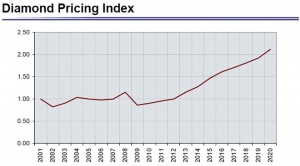

New Journal Article by Paul Slegers of Infinity Diamonds

https://www.pricescope.com/journal/price-prediction-diamonds-my-analysis-alrosa-analysis

Paul, thank you for your contribution.

https://www.pricescope.com/journal/price-prediction-diamonds-my-analysis-alrosa-analysis

Paul, thank you for your contribution.

300x240.png)