- Joined

- Apr 23, 2018

- Messages

- 5,870

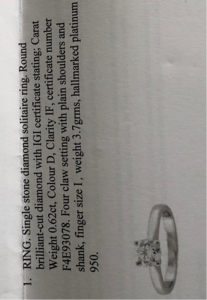

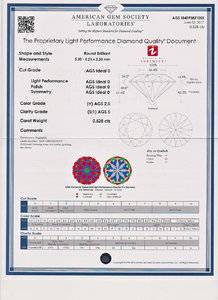

Using your picture, I think these might be some settings that are similar. I only had a top view, and from what I can tell, the shank tapers in towards the diamond. Assuming I have guessed right, I think it will cost you about $1,200-1,300 USD to replace the setting itself, maybe less or more depending which specific setting you choose.

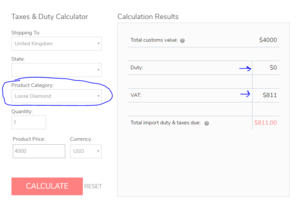

With import duties, taxes, etc. I think I was spot on about $4k USD for your diamond budget.

Here are some links to various settings I used to help determine my setting value above. By the way, I really like the first one, and assuming I correctly interpreted the taper, that was smart when making your initial purchase as it makes the diamond look bigger.

https://www.whiteflash.com/engageme...fany-style-solitaire-engagement-ring-1415.htm

https://www.whiteflash.com/engagement-rings/solitaire/comfort-fit-surprise-diamond-ring-600.htm

https://www.whiteflash.com/engageme...-sleek-line-solitaire-engagement-ring-729.htm

https://www.whiteflash.com/engageme...ni-1rz7241-solitaire-engagement-ring-3990.htm

https://www.whiteflash.com/engagement-rings/solitaire/fine-line-solitaire-engagement-ring-481.htm

Here are some stones for your consideration:

High Performance Diamonds:

HPD/CBI 0.77ct G VS1, 5.88x5.91mm, $4,218 USD

https://www.hpdiamonds.com/en-us/diamonddetail/HPD9639

HPD/CBI 0.72ct G VS1, 5.77x5.80mm, $3,747 USD

https://www.hpdiamonds.com/en-us/diamonddetail/HPD9732

HPD/CBI 0.72ct D SI1, 5.79x5.81mm, $3,739 USD

https://www.hpdiamonds.com/en-us/diamonddetail/HPD9386

HPD/CBI 0.70ct D VS2, 5.72x5.74mm, $4,204 USD

https://www.hpdiamonds.com/en-us/diamonddetail/HPD9377

WhiteFlash:

WF ACA 0.801ct F SI1, 5.97x5.99mm, $3,879 USD

https://www.whiteflash.com/loose-diamonds/round-cut-loose-diamond-3978029.htm

WF ACA 0.751ct G VS2, 5.85x5.87mm, $3,682 USD

https://www.whiteflash.com/loose-diamonds/round-cut-loose-diamond-3978029.htm

WF ACA 0.734ct F VS2, 5.77x5.80mm, $3,859 USD

https://www.whiteflash.com/loose-diamonds/round-cut-loose-diamond-4019088.htm

WF ACA 0.718ct D VS2, 5.74x5.76mm, $4,053 USD

https://www.whiteflash.com/loose-diamonds/round-cut-loose-diamond-4019079.htm

Brian Gavin Diamonds:

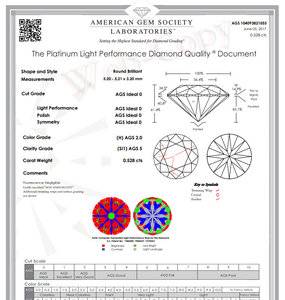

BGD Signature 0.712ct D SI1, 5.76x5.78mm, $3,918 USD

https://www.briangavindiamonds.com/...ls/0.712-d-si1-round-diamond-ags-104090535069

BlueNile @ UK:

BN GIA XXX 0.75ct F VS2, 5.86x5.85mm, ~$4,075 USD (3,168 GBP)

https://www.bluenile.com/uk/diamond-details/LD10909547

BN GIA XXX 0.71ct G VVS1, 5.71x5.67mm, ~$3,745 USD (2,911 GBP)

https://www.bluenile.com/uk/diamond-details/LD10653164

BN GIA XXX 0.70ct G VS2, 5.70x5.68mm, ~$3,317 USD (2,579 GBP)

https://www.bluenile.com/uk/diamond-details/LD10904126

300x240.png)