My wife lost her engagement ring. Our insurers have offered us a replacement which is 0.09ct larger, but has a medium blue fluorescence compared to our original that had none. When I questioned it they said that the uplift in size would compensate for the fluorescence. Are the correct, or are they supplying an inferior diamond? Are we better insisting on a diamond the same size as our original with no fluorescence? Both for quality, and as an investment which is the better diamond?

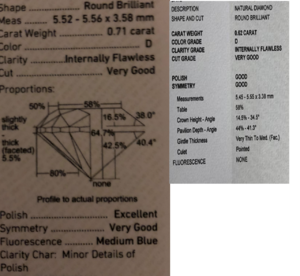

I've attached the details of both below. Our original is the one without a picture, the proposed replacement is the one with the diamond diagram.

Many thanks in advance!

I've attached the details of both below. Our original is the one without a picture, the proposed replacement is the one with the diamond diagram.

Many thanks in advance!

300x240.png)