How Are Diamonds Made? Natural vs Lab-Created Explained

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

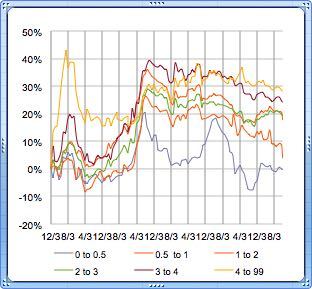

We’re 3 months into 2022. In Jan and Feb there was a continued recovery in natural diamond prices, from their low in 2020. As we entered March prices increased notably, possibly reflecting a reaction to sanctions against Russia which specifically name diamonds (Russia produces 1/3 of the world’s diamonds). Let’s take a closer look at the Top 5 Popular Diamond Shapes and state of Natural Diamond Prices for March 2022:

Round diamonds continue to be the most popular shape of diamonds on the market making up 70.92% (popularity) but decreasing (-4.42%) in popularity since last month. Oval continues to sit in second place making up 6.66% (popularity) and slightly increased in popularity (0.3%) since last month. Cushion remains in third place making up 6.41% (popularity) and slightly increased in popularity (0.76%) since last month. Emerald continues to sit in fourth place and we welcomed a new shape to the Top 5 Popular Diamond Shapes in February, radiant.

The table below gives you the rundown and details of the changes for the last three months.

| Diamond Price Changes from 1/1/2022 to 3/1/2022 | |||

| Diamond Carat Sizes | 1/1/2022 | 2/1/2022 | 3/1/2022 |

| 0.0 – 0.5 | 1 % ↑ | 1 % ↑ | 6 % ↑ |

| 0.5 – 1.0 | 0 % | 2 % | 7 % ↑ |

| 1.0 – 2.0 | 3 % ↑ | 2 % ↑ | 4 % ↑ |

| 2.0 – 3.0 | 4 % ↑ | 2 % ↑ | 3 % ↑ |

| 3.0 – 4.0 | 1 % ↑ | 4 % ↑ | 3 % ↑ |

| 4.0 – 99 | 5 % ↑ | 2 % ↑ | 1 % ↑ |

This March the average price per carat for a round diamond of 1 – 1.19 carat G color VS1 clarity is $10,158 compared to February 2022 which was an average price of $8,632. The average price per carat for round diamonds has increased this month.

The current average and lowest prices per carat are shown in PriceScope’s diamond price charts by carat and their corresponding color and clarity.

We advise consumers to keep in mind that cut quality and vendor services such as upgrades and returns can make a significant difference in the price point when shopping for loose diamonds. PriceScope has been collecting retail diamond prices since 2007 of over 500,000 diamonds. PriceScope diamond price chart page shows the full diamond price charts for rounds and other fancy shapes. We update the diamond prices on a monthly basis. Keep an eye out for April’s diamond prices.

Despite economic challenges, we saw a spike in the average price of natural diamonds for the month of March. We feel confident that the natural diamond industry will go from strength to strength this 2022. We would love to know your April natural diamond industry predictions – Click the comments button below.

Whether you’re actively shopping for natural diamonds or just browsing – Check out the PriceScope Diamond Search.

Retail Diamond Prices Chart Updated Monthly.

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

A Wedding Ring as Unique as Your Love Finding the right wedding ring isn’t just about diamonds or gold – it’s about finding the one that feels right. With hundreds…

So, you’re thinking about lab-grown diamonds? Smart move. They’re just as sparkly as the natural kind but usually cost less. But where do you actually go to buy them? It…

Want to stay updated on the most recent blogs, forum posts, and educational articles? Sign up for Bling News, PriceScope’s weekly newsletter.