- Joined

- Jan 21, 2018

- Messages

- 113

ASET is so badly taken it is useless.

I third the call for posting the numbers.

Could you please elaborate on why is it badly taken? Thanks

ASET is so badly taken it is useless.

I third the call for posting the numbers.

Light leakage into the top of the scope, stone tilted slightly, the back light is over bright and the placement of the stone vertically in the scope is off. Camera/stone/scope alignment also looks off.Could you please elaborate on why is it badly taken? Thanks

Not a huge fan of either but prefer the second one.Would love additional feedback on the following stones if possible:

https://www.yadavjewelry.com/products/Round-diamond-E-VVS2-YD2526140

https://www.yadavjewelry.com/diamonds/2726135

Thanks!

Not a huge fan of either but prefer the second one.

I tend to concentrate on the cut when asked for a choice between select stones.Based on the Price:Value ratio, or the cut of the stone?

Of those, I would say (IMVHO) that these are the best cut:Doubling down on the Canada Mark diamond - leaving JA as the best source. I've narrowed it down to the following list - any recommendations on best stones from the list?

https://www.jamesallen.com/loose-di...20600&ViewsOptions=Images&CM=True&Shape=round

Thanks in advance!

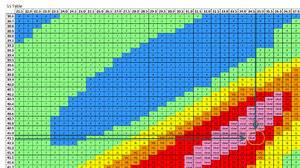

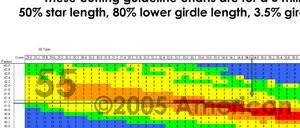

@sledge and @blueMA , it may be useful to know that this chart doesn't correspond to AGSL guidelines for Ideal/0 in their Platinum light performance metric. It reflects the more lenient ID-EX-VG system used in their 2D "Gold" proportions system from 2008.

@sledge and @blueMA , it may be useful to know that this chart doesn't correspond to AGSL guidelines for Ideal/0 in their Platinum light performance metric. It reflects the more lenient ID-EX-VG system used in their 2D "Gold" proportions system from 2008.

Gold (2D) Proportions Quality Report example here.

http://www.americangemsociety.org/page/agslabsgolddiamon

That report was designed to mimic GIA's more factory-friendly approach, giving a predictive grade based on averaged 2D proportions. Those charts are not as liberal as GIA's proportions system, but they are not as strict as the cutting guides for the 3D light performance grade.

Here's prior discussion on the topic, with examples of changes over the years.

https://www.pricescope.com/communit...tes-can-experts-chime-in.129850/#post-2285615

Thank you @John Pollard. I wasn’t aware I was using antiquated data. I will read the linked thread and am hopeful a different reference is available that is as quick and easy but I suspect not.

@sledge, you're very welcome. And to be clear, it's not antiquated. That Gold report is still offered as a less-strict path for producers who focus only on 2D averages.Thank you @John Pollard. I wasn’t aware I was using antiquated data. I will read the linked thread and am hopeful a different reference is available that is as quick and easy but I suspect not.

There are no hard charts because the 3D platinum metric is diamond-specific. Diamonds with identical average proportions can receive different performance grades based on how the 57 facets work together, beyond the numbers....hopeful a different reference is available that is as quick and easy but I suspect not.

Sledge - the chart is still useful to get a sense good proportions, and while it's not absolute it's not exactly antiquated. This is why you still have to look at the stone images/videos.

If you make an excel chart out of all super-ideal vendor inventories, you'll notice that the majority fall near the middle of the ideals plot, and most drop-shippers tend to carry the edge of the ideals (brand-rejects).

There are no hard charts because the 3D platinum metric is diamond-specific. Diamonds with identical average proportions can receive different performance grades based on how the 57 facets work together, beyond the numbers.

Sure, when used in proper context. In this case those Gold charts are not predicting AGS Ideal/0 in light performance. They show Ideal proportions in a lesser metric. That distinction may be useful to note.Thanks @John Pollard - of course the chart is just a reference as is the HCA and other tools.

In this case those Gold charts are not predicting AGS Ideal/0 in light performance.

Sure. Not in question. I posted because I thought it may be useful to mention that those charts accompany a different AGS system which doesn't employ light performance. I'm regularly clarifying this with pros who find them on the AGS site, because it's not made very evident on the charts themselves.@John Pollard Would you agree that if a diamond has good proportions, the image has very high optical symmetry, good equal star facet patterns along with Arrows patterns, with minimal table obstructions/clustering/leakage, the chances are that the 57 facets work well together?

Context first. AGS published 115 guides for RB organized by mm spread and table size. Those in the conventional ideal range follow the main cutter’s line rather closely, with the most robust areas system-wide landing on modern Tolkowsky. That’s no surprise. We and other niche specialists were glad to see scientific validation of practices we were following long before 2005. Some of us presumed it could change the industry.Out of curiosity, do any cutters still abide by those 2005 AGS cut recommendations?

Correct. But internet vendors are just the tip of a massive iceberg. If you were a trader analyzing the totality of polished output from Mumbai to Antwerp to New York or (this would be cheaper) if you just get an office, a RapNet subscription and a pizza, and start pulling numbers on the >1,000,000 RBs for sale - you’ll see an overwhelming trend towards proportions the regulars here would call 'steep-deep.' Why? Simple economics. Steeper angles put more weight in diamonds. More weight brings more profit. That's why the majority of the world's RB output is > HCA 2.0 and has deficiencies in IS or ASET.I see most vendors ranging near the T ideal proportions.

Super-ideal vendor inventories represent a comically tiny fraction of world output. Even adding the larger inventories classified as ‘signature’ or ‘ideal’ from big online sellers, you’re only scratching the tip of a steep-deep iceberg (see what I did there?). For that reason I applaud the sellers making an honest effort to cull and present options capable of serving cut-educated shoppers. And thus, I would not characterize the options at the 'edge of the ideals' as brand-rejects. I would call them promising hopefuls which finished above the average chaff.If you make an excel chart out of all super-ideal vendor inventories, you'll notice that the majority fall near the middle of the ideals plot, and most drop-shippers tend to carry the edge of the ideals (brand-rejects).

Tip of the hat.Every day is a school day with John around!Thank you very much for posting that info, it's really useful

Some of the cutters that were cutting h&a quality stones found they were not getting enough of a premium for it and turned what they knew about control of the cutting process into creating wide ranging pavilion angled stones that at first glance appear to have good numbers and in other cases to push the border of gia ex even further down. The results is some of them having good looking numbers but poor looking IS/ASET with a lot of variation around the stone.

The planning software even has settings that allow them to plan it.

No, they are not targeting h&a any longer. They are targeting higher weight retention but the numbers still look good on the report.I read this on PS a while back - Should I interpret that they're deliberately sabotaging the stock so that H&A gets more differentiated to justify for higher premium?

Ah OK thanks for that clarification. It's sad they'd deliberately twist the pavilions which directly compromise light performance while they're perfectly capable of producing high precision H&A stones. For economics or not, dark nevertheless...No, they are not targeting h&a any longer. They are targeting higher weight retention but the numbers still look good on the report.