CaseyLouLou

Brilliant_Rock

- Joined

- Dec 22, 2019

- Messages

- 1,257

Has anyone had problems or bad experiences selling items on Loupe Troop?

One time I had someone ask to use PayPal goods and services and I just had a bad feeling that they were going to file a complaint to get their money back and I would lose the item.

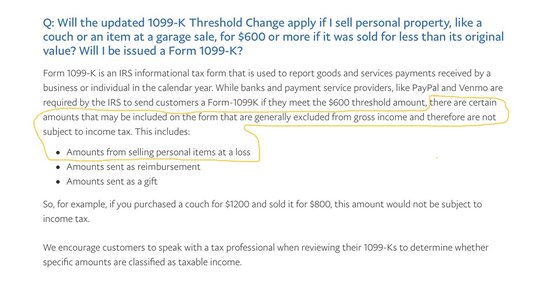

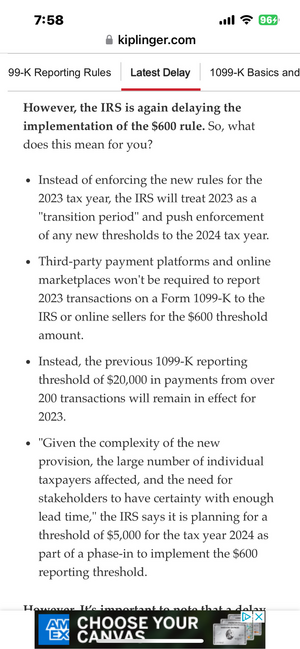

I have also had weird vibes recently from someone asking me for my best price if they buy today. Now with the way PP is reporting for tax purposes I’m not sure I even want to use it to accept payments. Are there any other options?

What’s the safest way to sell items and exchange money on LT? Thank you.

One time I had someone ask to use PayPal goods and services and I just had a bad feeling that they were going to file a complaint to get their money back and I would lose the item.

I have also had weird vibes recently from someone asking me for my best price if they buy today. Now with the way PP is reporting for tax purposes I’m not sure I even want to use it to accept payments. Are there any other options?

What’s the safest way to sell items and exchange money on LT? Thank you.

300x240.png)