SB621

Ideal_Rock

- Joined

- Aug 25, 2009

- Messages

- 7,864

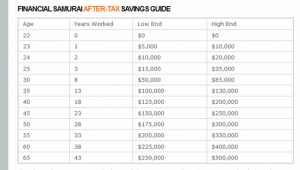

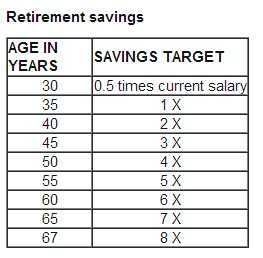

While we seem to be on the topic of savings lately in the HO I thought I would post this chart I found.

Last night I was trying to figure out if DH and I were putting enough away into our 401k's for our age group and I found this chart. It *seems* to be what most financial websites agree with (vanguard, ING etc). We are doing pretty good for our age group but I have to say it/ the numbers looks daunting to me for some reason as everything goes up as we get older. Perhaps I should stop buying jeweler

Last night I was trying to figure out if DH and I were putting enough away into our 401k's for our age group and I found this chart. It *seems* to be what most financial websites agree with (vanguard, ING etc). We are doing pretty good for our age group but I have to say it/ the numbers looks daunting to me for some reason as everything goes up as we get older. Perhaps I should stop buying jeweler

300x240.png)