oshinbreez

Brilliant_Rock

- Joined

- Jun 16, 2006

- Messages

- 1,135

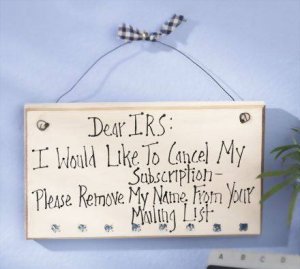

Maise,

It is such a pain. I did bookkeeping and taxes for years. I absolutely HATED this time of year.

I just talked to David, and he didn''t get his done, or file an extension. So, he''ll have a penalty unless he can fill out a form tonight and get it mailed. He just told me he never downloaded his w-2, so he has no idea what to even estimate.

After we get married, I''ll have to joy of doing it all.

After we get married, I''ll have to joy of doing it all.

It is such a pain. I did bookkeeping and taxes for years. I absolutely HATED this time of year.

I just talked to David, and he didn''t get his done, or file an extension. So, he''ll have a penalty unless he can fill out a form tonight and get it mailed. He just told me he never downloaded his w-2, so he has no idea what to even estimate.

300x240.png)