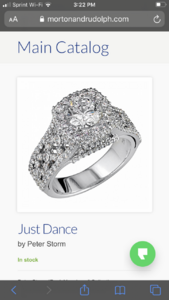

So a little less than 2 years ago I bought my now wife this engagement ring from Peter Storm. I had a 1.43 ct. G; eye clean SI1; triple ex.

Peter Storm. I had a 1.43 ct. G; eye clean SI1; triple ex.

A couple months ago, the top came off (Halo, Main Diamond, and halo) of the band and was lost. Obviously we were devastated. She loved her ring.

Insured value was $18,500. I contacted jeweler where I purchased, and she got a repair estimate from Peter Storm, which was $15,000. That was reasonable to us. USAA required we have the ring sent in for their gemologist to review. Their repair estimate is $9,200.

Do I have any ability to refute their estimate? I assume they picked a virtual diamond that is not as high within the respective grades. The setting had 150 diamonds totaling 1.40 ct; f/g vs1 and a sizable amount of gold given its a ring.

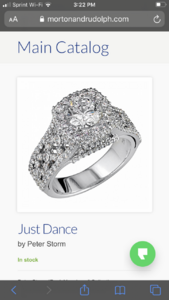

Peter Storm. I had a 1.43 ct. G; eye clean SI1; triple ex.

Peter Storm. I had a 1.43 ct. G; eye clean SI1; triple ex.A couple months ago, the top came off (Halo, Main Diamond, and halo) of the band and was lost. Obviously we were devastated. She loved her ring.

Insured value was $18,500. I contacted jeweler where I purchased, and she got a repair estimate from Peter Storm, which was $15,000. That was reasonable to us. USAA required we have the ring sent in for their gemologist to review. Their repair estimate is $9,200.

Do I have any ability to refute their estimate? I assume they picked a virtual diamond that is not as high within the respective grades. The setting had 150 diamonds totaling 1.40 ct; f/g vs1 and a sizable amount of gold given its a ring.

300x240.png)