luckynumber

Brilliant_Rock

- Joined

- Oct 22, 2009

- Messages

- 665

Absolutely not and I need to add that I am in no way connected to them. I am simply a (very) happy customer.Date: 10/30/2009 7:31:12 PM

Author: FB.

Loving Diamonds

Interesting about diamondgeezer.

I have been aware of their existence, but the website sounds like a gimmick, with such things as 'normal price' and 'today's price' listed for a diamond.

An example of their pricing policy that makes me very wary:

High Street: £522

Usual Price: £353

CRUNCH PRICE: £307

Saving an extra £46!

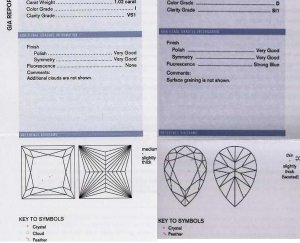

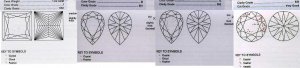

IGI and to some extent HRD certificates are generally less detailed and sometimes less trusted than GIA equivalent.

There is no ability to examine the certificate for the stones listed - and, like other UK sellers - no images listed.

From what you say, it sounds like a 'trust me, I'll look after you' kind of business.While that may be true and they may be very good to their customers, their website design makes me cautious.

Having never dealt with them - because of the website - I can't comment on how good or bad they are in reality. I would love to hear more positive comments from PS members about this company, since I am also generally fed up with the poor offerings in the UK.

Date: 11/1/2009 7:26:47 AM

Author: nellen

LovingDiamonds,

I would really prefer to require the upgrade diamond from the EU since I wouldn''t have to pay VAT and custom tax that I would have to pay if I purchased the diamond from the US. That would save me plenty of euros that I could spend on the diamond instead.

Great post M'' Lud!!Date: 11/12/2009 8:29:33 AM

Author: Lord Summerisle

Date: 11/1/2009 7:26:47 AM

Author: nellen

LovingDiamonds,

I would really prefer to require the upgrade diamond from the EU since I wouldn''t have to pay VAT and custom tax that I would have to pay if I purchased the diamond from the US. That would save me plenty of euros that I could spend on the diamond instead.

You always have to pay VAT/Duty on importing items into the UK, it doesnt matter if it comes from the EU, USA, or worldwide.

the UK duty rates are set by the EU TARIC codes the 2 relevant codes are: 7102390000 - diamonds and 7113190000 for precious metals

If you buy in the UK, the VAT is payable at the time of purchase (sites like Blue Nile.co.uk so prices ex VAT then add it on at check out)

If you buy in the EU, then VAT will be added by customs on its entry to the UK via the shipping company. If you traveled to, say, antwerp and bought the stone there, you should, on your return to the UK, go through the RED channel at customs and pay the VAT on the stone/ring (tho you should be able to claim back the local VAT you paid in the country of purchase)

If you buy in the US - then since your out of state you dont pay local sales tax, and the ring is subject to Custom''s duty on its entry to the UK. from the above codes - importing from the US, diamonds on their own have no import duty (just VAT) but a complete ring has 2.5% import duty added before VAT.

to take a slightly different example - if you buy a DVD from a certain company that is a button on your DVDPLAYer - they are based in Jersey, on most purchases of a DVD you are not paying VAT on the item, and when it enters the UK, customs dont bother because it is under their VAT baseline (which is something like £20 - or it used to be) any order value over this would have VAT added.

Po10472Date: 10/31/2009 2:37:37 AM

Author: Po10472

FB, I have to agree with LD that we're not 'poorly served' here in the UK, we're generally less informed. There are very few people I know who understand the 4c's and jewellery companies don't exactly go out there way to enlighten the discerning customer when they arrive on their doorstep. It's all about knowledge in this game and from what I've read about on PS over the last few years, its likewise in the US too.

If you have the diamond knowledge, know what you want and stick to your budget, you can find vendors in the UK who will offer and match the same prices as those in the US, particularly in this economic climate, you just need to source a vendor. The majority of diamond shoppers out there don't do research, they walk into a B&M store, who have lovely halogen lights and increased prices to cover their shop rental and sell thousands upon thousands of diamonds, some are winners some aren't. We also don't have a culture in the UK for including certificates, so GIA means nothing to a lot of people as it may do in the US.

I've been engaged twice, first time, we walked into a shop in the diamond district and picked out a pretty ring, it was sparkly and I loved it, marquise cut, it didn't come with a certificate and it was an H, SI2.....many moons later and different relationship, my DH and I still had no clue, we just wanted to be engaged and get on with our lives, again, no research done, walked into a B&M store and this time came out with an EC with was appraised as a corker, G, VS2, but again no certificate.

Now I'm knowledgeable, well..... enough to know what a good diamond is and have since bought from the US which at the time was cheaper and came with a certificate. However, I have now sourced a vendor who made my sister an amazing 3-stone ring (pics to follow on another thread one day), I know that he could get me what I wanted at a price that was comparable with the US, with or without a certificate. He gets his diamonds from the same place that vendors in the US get theres. I have no doubt that when the time comes when I hopefully will get my 1.75ct EC upgrade I will go to Anthony first, if he's unable to get the stock or the price is too high, then I'll look at GOG, Whiteflash etc. I wouldn't rule out the UK straight off anymore.

Date: 11/12/2009 8:29:33 AM

Author: Lord Summerisle

Date: 11/1/2009 7:26:47 AM

Author: nellen

LovingDiamonds,

I would really prefer to require the upgrade diamond from the EU since I wouldn''t have to pay VAT and custom tax that I would have to pay if I purchased the diamond from the US. That would save me plenty of euros that I could spend on the diamond instead.

You always have to pay VAT/Duty on importing items into the UK, it doesnt matter if it comes from the EU, USA, or worldwide.

the UK duty rates are set by the EU TARIC codes the 2 relevant codes are: 7102390000 - diamonds and 7113190000 for precious metals

If you buy in the UK, the VAT is payable at the time of purchase (sites like Blue Nile.co.uk so prices ex VAT then add it on at check out)

If you buy in the EU, then VAT will be added by customs on its entry to the UK via the shipping company. If you traveled to, say, antwerp and bought the stone there, you should, on your return to the UK, go through the RED channel at customs and pay the VAT on the stone/ring (tho you should be able to claim back the local VAT you paid in the country of purchase)

If you buy in the US - then since your out of state you dont pay local sales tax, and the ring is subject to Custom''s duty on its entry to the UK. from the above codes - importing from the US, diamonds on their own have no import duty (just VAT) but a complete ring has 2.5% import duty added before VAT.

to take a slightly different example - if you buy a DVD from a certain company that is a button on your DVDPLAYer - they are based in Jersey, on most purchases of a DVD you are not paying VAT on the item, and when it enters the UK, customs dont bother because it is under their VAT baseline (which is something like £20 - or it used to be) any order value over this would have VAT added.

Date: 11/12/2009 10:45:50 AM

Author: nellen

Date: 11/12/2009 8:29:33 AM

Please note that I am not importing into UK but exporting from the UK. With a quick look to the custom legislation in Finland I did not see any information on paying VAT or custom tax because the VAT is already paid in the UK by the seller. If I were to pay VAT, the product would have been charged the VAT twice although in different countries.

My apologies then, i hadnt picked up on that little Finland detail (how appropriate that i''m currently listening to Nightwish at the mo)

The import duty codes are the same through out the EU, so the codes i gave above can be used on the EU tax code websitehere just put the code in the box for the required item type (or do a text search) and the country of origin of the item and it will tell you what the duty rate is.

So for importing from the US - diamonds have no import duty, but precious metal (silver, gold, platinum etc.) have a import duty of 2.5% - then VAT is added.

Now importing from anywhere in the EU there is no import duty, just VAT. But if finland dont charge VAT on EU imports as its already been charge in the country of origin then that makes life alot simpler - i believe the UK will also charge VAT - but there is a way of claiming back the VAT charged in a foreign country so you are not paying VAT twice.

But since thats the case - then i would also suggest looking at Infinity Diamonds - they have several EU based dealers, as well as our very own Wink and Todd of High Performance Diamonds.

theres Indira @ Best Diamonds in London, DiamondHouse in Beligum, Suokko Kultasepanliike in Tampere - Finland