You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Diamond prices - will they rise or fall?

- Thread starter nanarama

- Start date

centralsquare

Ideal_Rock

- Joined

- Jan 18, 2009

- Messages

- 2,216

I'm by no means an expert, but from reading other threads, seems there are two dynamics causing prices to rise:

1. Weak dollar - this may get better as we continue through recovery

2. Increased demand - primary from other countries...this seems likely to continue

I guess you are asking for our opinions...so, I think that the economy will get better, but that the real price will continue to increase due to #2.

1. Weak dollar - this may get better as we continue through recovery

2. Increased demand - primary from other countries...this seems likely to continue

I guess you are asking for our opinions...so, I think that the economy will get better, but that the real price will continue to increase due to #2.

centralsquare

Ideal_Rock

- Joined

- Jan 18, 2009

- Messages

- 2,216

kenny|1313447983|2991512 said:Wouldn't a better economy increase demand?

That's a good point... my personal demand hasn't changed due to the economy, but I'm sure overall demand has as well!

kenny|1313447983|2991512 said:Wouldn't a better economy increase demand?

Wouldn't rising affluence and population in China and India increase demand?

When the economy is good, usually gold, silver, diamond etc etc go down because people have faith in the dollar (they don't feel like they need to hold their currency in gold etc).

But yes - the increasing demand from other countries may cancel that out and prices may continue to rise regardless of the economy.

So confusing...to buy now...or to wait... hmm....

- Joined

- Apr 30, 2005

- Messages

- 33,509

Nobody can foresee the future.nanarama|1313449339|2991533 said:So confusing...to buy now...or to wait... hmm....

May I suggest you just buy what you love and can afford today?

Ignore if it goes up or down in value in the future.

Just enjoy your diamond.

Besides diamonds are NOT an investment because we have to pay retail but sell at wholesale.

- Joined

- May 1, 2008

- Messages

- 3,563

For anyone interested in an in-depth look at this subject I posted a review of Martin Rapaport's "State of the Diamond Industry" from earlier this summer. It's lengthy but much of it involves diamond pricing futures, both globally and in the USA.

2011 Rapaport State of the Diamond Industry: The New Normal

Jumping further down in that thread, here is a supply overview and pricing predictions based on research by Alrosa and the AllanHochreiter group.

https://www.pricescope.com/communit...-the-new-normal.163913/#post-2984403#p2984403

Cheers,

2011 Rapaport State of the Diamond Industry: The New Normal

Jumping further down in that thread, here is a supply overview and pricing predictions based on research by Alrosa and the AllanHochreiter group.

https://www.pricescope.com/communit...-the-new-normal.163913/#post-2984403#p2984403

Cheers,

- Joined

- Jan 7, 2009

- Messages

- 9,757

It was a great post John!

Do you think the forecast would be the same if made today?

Do you think the forecast would be the same if made today?

- Joined

- May 1, 2008

- Messages

- 3,563

Rockdiamond|1313452910|2991555 said:It was a great post John!

Do you think the forecast would be the same if made today?

Thank you David. Regarding the forecast, I imagine so. Nothing in the macro has changed to alter it.

In terms of global demand, I've been in HK and China a few times in recent years and was in Shanghai just a week after Mr. Rapaport's presentation in June. It's all about numbers (of people) and there is no reason to doubt those growth predictions when they've met or exceeded expectations for nearly a decade. It will take such tiny continued growth there, relative to the big picture, to meet the demand forecasts. It's the same with India, especially when looking at the age-demographics there. On a side note, while visiting several diamond manufacturing facilities in Surat last year, I was quite impressed with the advanced technology I saw employed in Indian diamond planning/manufacturing. The way they are setting up factories looks to be extremely cost-effective and time-saving in the long run.

On the domestic front, Ken Gassman reported that the number of marriages in the US is expected to rise by at least 20% over the next five-to-six years in his JCK keynote last year.

Regarding supply, look over my second link above: The Canadian kimberlite clusters are the strongest projects in development and will replace the strongest current sources as we approach 2020. But demand forecasts all exceed that replacement potential and any new source discovery will take nearly a decade to develop if begun now. From a report according to Alrosa, the anticipated gap between expected supply and demand for rough diamonds may result in a 31% growth in rough diamond prices by 2018 relative to 2008 prices, or a 55% growth if the USD inflation of 2.0-2.5% per year is taken into account.

So the forecast has remained pretty much the same since 2005 - at least in my tracking of it - and has not veered from its course. Bloomberg covered the topic over a year ago. Here is a review of that coverage, if you're interested:

http://www.polishedprices.com/news/NewsDetails.aspx?NewsId=1000006643

JoeNewbie11

Shiny_Rock

- Joined

- Mar 27, 2008

- Messages

- 406

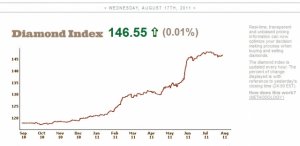

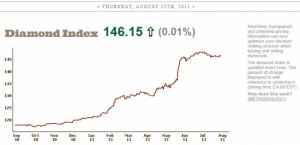

Over the past 16 months, polished prices have increased about 30% according to the PS diamond price chart. Is this trend sustainable? Will buyers continue to pay more and more for the same thing? I highly doubt it, but buyers have to speak with their wallet. I like to draw a parallel to the housing bubbles observed around the world. Experts explained the price increases were due to a new paradigm in housing and demand. In the end the bubbles always burst. My guess is there may be some manipulation of rough supply. I have a hard time believing organic demand world-wide is greater now considering we're still in a global recession masked by artificial stimulus. I won't pay 30% more than 16 months ago, why would people in China, India, or USA?

- Joined

- May 1, 2008

- Messages

- 3,563

JoeNewbie11|1313457959|2991603 said:Over the past 16 months, polished prices have increased about 30% according to the PS diamond price chart. Is this trend sustainable? Will buyers continue to pay more and more for the same thing? I highly doubt it, but buyers have to speak with their wallet. I like to draw a parallel to the housing bubbles observed around the world. Experts explained the price increases were due to a new paradigm in housing and demand. In the end the bubbles always burst. My guess is there may be some manipulation of rough supply. I have a hard time believing organic demand world-wide is greater now considering we're still in a global recession masked by artificial stimulus. I won't pay 30% more than 16 months ago, why would people in China, India, or USA?

In the USA buyers seem to be adjusting. They have not stopped spending, they have changed their expectations. Even now, with prices and the economy doing a double-whammy, bridal sales remain strong. Stores selling our brand have reported that the most frequently moving size/color/clarity this year is lower than what it was last year. So while experienced buyers may very well say "enough-is-enough" it seems likely that new grooms-to-be will continue to spend what they had budgeted - but may learn to shop smarter.

China and India have a totally different climate. Those countries are producing 80 million new consumers each year who want diamonds and for the first time they have money to get them... If I were a veteran diamond-buyer living there I imagine you're right. I might say "Wow these prices have gone up!" But that's not the demographic that's causing the global demand-surge we are feeling. It's new buyers with new money who have no preconceptions about what XYZ should cost.

There was some related discussion a few months ago, with similar viewpoints expressed.

https://www.pricescope.com/communit...-at-what-point-will-the-consumers-say.158970/

maplefemme

Brilliant_Rock

- Joined

- May 12, 2011

- Messages

- 874

John, I really appreciate your ever insightful posts and so I'm curious about your thoughts on JCK's Rob Bates article on the recent softening of prices, specifically pointing out GIA graded stones....

- Joined

- May 1, 2008

- Messages

- 3,563

maplefemme|1313541812|2992283 said:John, I really appreciate your ever insightful posts and so I'm curious about your thoughts on JCK's Rob Bates article on the recent softening of prices, specifically pointing out GIA graded stones....

Thanks for the kind feedback.

I suspect - and hope - that Mr. Bates is correct about a softening in the disproportionate pricing of melee goods. I tend to agree with those in the article who expect that in normal sizes we'll see a correction, not steady declines. Looking at pricing history over the last year there have been multiple corrections within the overall trend of increases; see the chart below - keeping in mind that if diamonds were valued in a currency other than the USD the increases would not seem so exaggerated.

For those who are wondering, JCK's Rob Bates article can be found here http://www.jckonline.com/2011/08/16/diamond-prices-starting-to-weaken

centralsquare

Ideal_Rock

- Joined

- Jan 18, 2009

- Messages

- 2,216

Very interesting. Thanks for posting!

maplefemme

Brilliant_Rock

- Joined

- May 12, 2011

- Messages

- 874

John Pollard|1313558956|2992425 said:maplefemme|1313541812|2992283 said:John, I really appreciate your ever insightful posts and so I'm curious about your thoughts on JCK's Rob Bates article on the recent softening of prices, specifically pointing out GIA graded stones....

Thanks for the kind feedback.

I suspect - and hope - that Mr. Bates is correct about a softening in the disproportionate pricing of melee goods. I tend to agree with those in the article who expect that in normal sizes we'll see a correction, not steady declines. Looking at pricing history over the last year there have been multiple corrections within the overall trend of increases; see the chart below - keeping in mind that if diamonds were valued in a currency other than the USD the increases would not seem so exaggerated.

Thank you John, very interesting...

PS> Thank you for posting the link scepture.

- Joined

- May 1, 2008

- Messages

- 3,563

Eight days later pricing has largely remained flat.

This week's article from Rob Bates. Some good insights, I think.

http://www.jckonline.com/blogs/cutting-remarks/2011/08/24/bhp-price-drop-canary-diamond-mine

This week's article from Rob Bates. Some good insights, I think.

http://www.jckonline.com/blogs/cutting-remarks/2011/08/24/bhp-price-drop-canary-diamond-mine

centralsquare

Ideal_Rock

- Joined

- Jan 18, 2009

- Messages

- 2,216

Let's hope it stays that way!

- Joined

- Apr 28, 2008

- Messages

- 11,676

centralsquare|1314313506|2999676 said:Let's hope it stays that way!

Here here!

Otherwise, I see a lot of colored stone e-rings in the future.

centralsquare

Ideal_Rock

- Joined

- Jan 18, 2009

- Messages

- 2,216

Laila619|1314332333|2999915 said:centralsquare|1314313506|2999676 said:Let's hope it stays that way!

Here here!

Otherwise, I see a lot of colored stone e-rings in the future.

Well, the price of gold is making that more difficult as well.

Black Jade

Brilliant_Rock

- Joined

- Aug 21, 2008

- Messages

- 1,242

From what I saw in China (this is anecdotal evidence by its very nature) and in the Chinese fashion magazines I have been reading, the diamonds that are in demand there are not at all the kinds of goods that are in demand here. Chinese engagement rings have what most would call 'melee' here in them as center stones. To me the rings are delicate and pretty, but the majority of diamonds are smaller than 20 points, many of them actually smaller than 10 points. They do have beautiful color and clarity. I am talking about solitaire rings here, with ONE stone of a very small size.

Since Americans are so 'size-conscious' (to put it neutrally), I have to wonder exactly why this is affecting our market. It would seem that these are two entirely different kinds of goods, since most American women, from what I can tell, aspire to a diamond of one carat even when they are not here on Pricescope where the 'smaller diamonds' thread is called 'one carat and under'. Of course most American women don't HAVE a one carat solitaire, but I would say that rings under 1/3 carat in the US are few, and rings under 10 points are pretty well nonexistent (unless you go antique).

I don't know anything about the Indian market--the Indian ladies I know are all older and don't care much about diamonds, only about 22 carat gold.

Since Americans are so 'size-conscious' (to put it neutrally), I have to wonder exactly why this is affecting our market. It would seem that these are two entirely different kinds of goods, since most American women, from what I can tell, aspire to a diamond of one carat even when they are not here on Pricescope where the 'smaller diamonds' thread is called 'one carat and under'. Of course most American women don't HAVE a one carat solitaire, but I would say that rings under 1/3 carat in the US are few, and rings under 10 points are pretty well nonexistent (unless you go antique).

I don't know anything about the Indian market--the Indian ladies I know are all older and don't care much about diamonds, only about 22 carat gold.

- Joined

- May 1, 2008

- Messages

- 3,563

Jade,

You're correct, the majority of Chinese (over 90%) are either not equipped to buy a diamond or are buying <0.30 cts... Only the top 3-5% of the total population is economically equipped to buy 1ct+. But that tiny 5% of China's population is a whopping 67,000,000 people influencing global demand; equal to 22% of the US population.

Considering the small amount of the population engaged in 1ct diamond buying (forgive the pun) it makes sense if 90% or more of stores on the mainland do not yet stock or sell 1ct-ish sizes. In contrast, I've visited Chow Tai Fook and Chow Sang Sang locations in Beijing and Shanghai with healthy inventories in 0.50-2.00ct - and moving them well. But those are stores in major population centers which are catering to that 3-5% of the people.

While HK is a different game I'd note that in the past couple of years I've seen more 0.50ct-plus being stocked in "average" HK stores. If China's economy continues to grow it's predictable that the presence of goods in larger sizes will also grow on the mainland.

Here's a 2010 thread with discussion along these same lines that may be of interest: China on the Rise

Cheers,

You're correct, the majority of Chinese (over 90%) are either not equipped to buy a diamond or are buying <0.30 cts... Only the top 3-5% of the total population is economically equipped to buy 1ct+. But that tiny 5% of China's population is a whopping 67,000,000 people influencing global demand; equal to 22% of the US population.

Considering the small amount of the population engaged in 1ct diamond buying (forgive the pun) it makes sense if 90% or more of stores on the mainland do not yet stock or sell 1ct-ish sizes. In contrast, I've visited Chow Tai Fook and Chow Sang Sang locations in Beijing and Shanghai with healthy inventories in 0.50-2.00ct - and moving them well. But those are stores in major population centers which are catering to that 3-5% of the people.

While HK is a different game I'd note that in the past couple of years I've seen more 0.50ct-plus being stocked in "average" HK stores. If China's economy continues to grow it's predictable that the presence of goods in larger sizes will also grow on the mainland.

Here's a 2010 thread with discussion along these same lines that may be of interest: China on the Rise

Cheers,

Garry Holloway's New Book: How to Select the Best Diamonds Garry Holloway's New Book: How to Select the Best Diamonds - 07/26

Garry Holloway's New Book: How to Select the Best Diamonds - 07/26

300x240.png)