You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

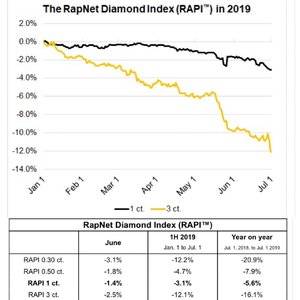

12% decrease for 3ct

- Thread starter EncikG

- Start date

- Joined

- Apr 3, 2004

- Messages

- 33,852

At this rate 3 ct stones will be free within the next few yrs.

Yes we do. A PSer had a killer upgrade bc she bought her prior stone at a high and the value went towards the upgrade which was at a low.

I think that’s limited to certain vendors

Even so, I highly doubt the discounts are across the caret ranges (i.e. I dun see 12-20% drop in prices for a 0.3ct)

- Joined

- Sep 3, 2000

- Messages

- 6,695

The change in prices on Rapaport represents a decrease in "dealer asking prices" and reflects an ongoing problem with competitive forces and profitability. Things are "tight" financially and to stimulate activity asking prices are on a decline in certain categories. However, existing inventory did not change in cost and it will be very challenging for retailers to just drop their prices in lock step with what is taking place upstream in any immediate or uniform way. The chart tells only a very small part of how diamonds get priced so hold off waiting for the crash. This current change as reported may not make a whole lot of difference in a visible way. Such changes are important to dealers holding millions of dollars in diamonds, but to consumers with one or a few diamonds, there is a different market than at the major dealer level.

- Joined

- Aug 15, 2000

- Messages

- 18,480

As Dave says, a lot of naughty rough importers got caught in India round robining the same parcel to get bigger loan benefits etc and the banks are getting smarter and tougher.

But i think the bigger reason is a larger number of type II very large rough is being discovered because of conveyor belt XRF technology (stops tnm being crushed) and hence there are more very large high colour high clarity goods then aver before.

So the D-EF to VVS goods I am seeing is much more than usual.

I bet there has not been such a big drop in FG VS SI

But i think the bigger reason is a larger number of type II very large rough is being discovered because of conveyor belt XRF technology (stops tnm being crushed) and hence there are more very large high colour high clarity goods then aver before.

So the D-EF to VVS goods I am seeing is much more than usual.

I bet there has not been such a big drop in FG VS SI

- Joined

- Sep 2, 2002

- Messages

- 2,859

I agree with the two reasons brought up by Garry, but in the other order.

Yes, new technology in mining leads to a higher number of bigger rough stones, remarkably so in very big stones. But I cannot see this aspect having such a big scope as the following.

Indeed, the last few years has seen a number of very big diamond-companies folding or currently in the process of folding, with losses mainly for banks giving credit-facilities to the industry. Many of these cased had losses over $500M each.

This is a case of not only a few billions in these losses not available in the diamond-pipeline. All banks servicing the diamond-industry have become far more wary. A high number of diamond-companies are under bank-pressure to reduce their credit-line, some to zero, before very clear deadlines. For those companies under pressure, offloading bigger diamonds at lower prices is the least damaging option. Given the extent in which financing-money is leaving our industry, this is a far more important cause for the current price-decline of the bigger diamonds.

Live long,

Yes, new technology in mining leads to a higher number of bigger rough stones, remarkably so in very big stones. But I cannot see this aspect having such a big scope as the following.

Indeed, the last few years has seen a number of very big diamond-companies folding or currently in the process of folding, with losses mainly for banks giving credit-facilities to the industry. Many of these cased had losses over $500M each.

This is a case of not only a few billions in these losses not available in the diamond-pipeline. All banks servicing the diamond-industry have become far more wary. A high number of diamond-companies are under bank-pressure to reduce their credit-line, some to zero, before very clear deadlines. For those companies under pressure, offloading bigger diamonds at lower prices is the least damaging option. Given the extent in which financing-money is leaving our industry, this is a far more important cause for the current price-decline of the bigger diamonds.

Live long,

- Joined

- Aug 15, 2000

- Messages

- 18,480

Hi Paul, a point, most of the very large diamonds are not cut into a single stone - e.g. some of the big rough Graff has bought recently was cut into a dozen or more +2ct stones all D F or D IF.I agree with the two reasons brought up by Garry, but in the other order.

Yes, new technology in mining leads to a higher number of bigger rough stones, remarkably so in very big stones. But I cannot see this aspect having such a big scope as the following.

Indeed, the last few years has seen a number of very big diamond-companies folding or currently in the process of folding, with losses mainly for banks giving credit-facilities to the industry. Many of these cased had losses over $500M each.

This is a case of not only a few billions in these losses not available in the diamond-pipeline. All banks servicing the diamond-industry have become far more wary. A high number of diamond-companies are under bank-pressure to reduce their credit-line, some to zero, before very clear deadlines. For those companies under pressure, offloading bigger diamonds at lower prices is the least damaging option. Given the extent in which financing-money is leaving our industry, this is a far more important cause for the current price-decline of the bigger diamonds.

Live long,

Ithink this is very common as they spend a lot more planning effort on very large rough and get way more window opportunities.

And seconly everyone else - note there has not been a plummet of prices on large stones as much as smaller on the PS data

https://www.pricescope.com/diamond-prices/diamond-prices-chart/

and this is because most of the diamonds listed here are not top top color and clarity because folks here are mostly buying bling for bucks

- Joined

- Oct 21, 2004

- Messages

- 5,096

There are just too much of everything in an industry who only requires about $15 (rough) -23 Billion (polished) @wholesale of fresh new diamonds on any given year for the last decade+/- or so.

Too many cutters

Too many wholesalers/dealers

Too many diamonds (with minor pockets of specific demands which everyone is looking for and are getting harder and more expensive to find/buy, and yes, also in the 3 carat sizes).

Just too much of too much...

In general, the ongoing and current race to sell the cheapest has come back to bite this industry!

This story is old and started back after the Sept 2008 crisis. Today we (and many other industries) are paying a heavy price.

In the diamond industry, this ongoing situation has been documented on PS since a decade ago:

Some early communications on this subject which will shine light on what is going on presently deep inside our industry roots!!

https://www.pricescope.com/communit...ing-a-price-bubble-again.117671/#post-2091560

https://www.pricescope.com/communit...prices-have-come-down-33.119135/#post-2066292

Too many cutters

Too many wholesalers/dealers

Too many diamonds (with minor pockets of specific demands which everyone is looking for and are getting harder and more expensive to find/buy, and yes, also in the 3 carat sizes).

Just too much of too much...

In general, the ongoing and current race to sell the cheapest has come back to bite this industry!

This story is old and started back after the Sept 2008 crisis. Today we (and many other industries) are paying a heavy price.

In the diamond industry, this ongoing situation has been documented on PS since a decade ago:

Some early communications on this subject which will shine light on what is going on presently deep inside our industry roots!!

https://www.pricescope.com/communit...ing-a-price-bubble-again.117671/#post-2091560

https://www.pricescope.com/communit...prices-have-come-down-33.119135/#post-2066292

Did You Miss the April 2024 Jewels of the Weeks? Did You Miss the April 2024 Jewels of the Weeks? - 04/26

Did You Miss the April 2024 Jewels of the Weeks? - 04/26

Did You Miss The Throwback Thursdays For April 2024?

Did You Miss The Throwback Thursdays For April 2024? - 04/25

300x240.png)