- Joined

- May 1, 2008

- Messages

- 3,563

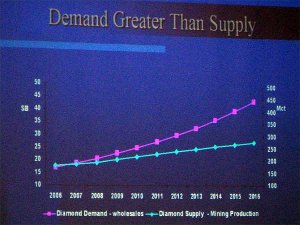

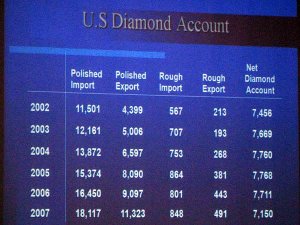

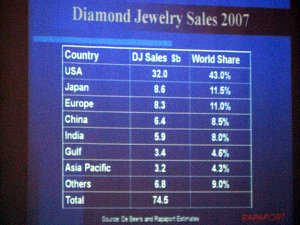

The Rapaport “State of the Diamond Industry” breakfast and seminar is highly anticipated each year. The 2008 event was at capacity, partly because the content is always useful and interesting, and partly because of a shocking upward adjustment in Rapaport's diamond pricing information that occurred just prior to JCK: People who were present wanted answers as well as opinions.

Note: Understanding the "State of the Industry" content will help to understand factors involved in the price hike.

Note: Understanding the "State of the Industry" content will help to understand factors involved in the price hike.

300x240.png)