Your first day, getting to know the product

This morning, you flew into an area in the Arctic, seeing a huge pit from your helicopter. On the ground, enormous trucks pass by carrying tonnes of earth. Your first question to the engineer, guiding you around: how many kilos of diamonds in such a truck?

He explains that you are now mining a very rich area and that each tonne of earth contains about 2 carats of diamonds. Not bad, you think, imagining a nice 2 Ct-round brilliant.

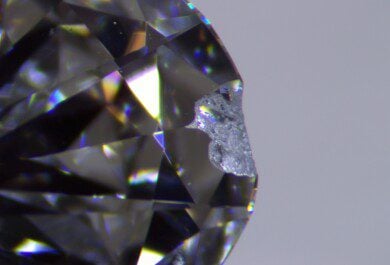

What a surprise, when you walk into the processing area, where the diamonds are recovered from the earth. You see tiny baubles, sometimes a nice crystal-shape, sometimes a bigger stone, a lot of colours, mostly brown and faint yellow, and on the odd occasion that you have a transparent stone, you always see these ugly black spots inside.

Your engineer explains that the biggest part of your mine’s production is diamonds for industrial use. With more and more synthetic diamonds being produced for industrial purposes, the value of these is constantly going down.

Of the smaller part, which can be used for jewellery, most is quite small in size, and rather heavily included. In the end, they will end up in cheap jewellery under 100$, mostly sold through TV-shopping channels and in mall stores. Luckily, some thirty years ago, some Indian diamond cutters have specialised in cutting these stones, and they have created a new market for your rough diamonds.

Fortunately, a small portion of your production is of a very high quality and rather big size, and within months, this will be sold as high quality diamonds, exactly the ones you dreamed about last night.

That evening, you think about the problem of having all kind of diamonds, industrial ones, cheap and small gem-quality and some nice high-quality. You realise that your complete production needs to be sold at the highest possible price, for you to make a profit.

Day number two, meeting with the government

The next day, you receive a delegation of the government. They explain that mining in this country is done under certain clear government regulations. When you export your rough diamonds (as you are doing for 100%), the government levies a small export tax of 5%.

Lately however, the government is under increased pressure to create more jobs, and they are considering the idea of promoting a local cutting industry. In order to achieve this, they need your “co-operation”.

The new policy will be that the export tax on rough diamonds will be increased to 10%. On the other hand, there will be no tax on rough diamonds, supplied to local cutters, and no export tax on the finished product, which they export.

You try to explain that this comes down to selling to local cutters at a 10% lower price, and they make you understand that this is exactly the point. By selling to local cutters cheaper than to the foreign ones, they can compensate their lack of experience and compete. This reduction of 10% in your overall earnings is exactly the co-operation that they have forced you to give.

On top of that, in the new government regulations, you will have to offer goods to local cutters first, before you are allowed to export them. Your assistant explains that, in this way, your loyal foreign customers will be disadvantaged, because the most interesting rough stones will be picked out by the local cutters.

Well, says the representative of the government, that is exactly the point: we are supporting a new local cutting industry.

Again, that evening, you have trouble finding your sleep. Percentages keep racing through your mind. But the end-result is always the same. If your foreign customers used to pay 100, of which 5 were the old export tax, that would leave you 95 net. With the new regulation, the local cutters buy the best rough at 90. And if you are lucky enough that the foreign cutters still want to pay 100 (even though the best rough is not included anymore), with the new export tax of 10, you will only have 90 left. All in all, with the same investment, work and output, the government has just taken away 5% of your turnover.

Day number three, meeting with De Beers

Your great-uncle had a contract with De Beers’, which arranged for them to purchase your whole production and for them to market it. As soon as rough was mined, it would be sorted into hundreds of different qualities and sizes, each with his own price-level, at which De Beers’ would sell that quality. You received 85% of that total price.

By the end of the year, you have to decide whether to renew this contract. Your assistants quickly briefed you about the situation:

Lately, De Beers’ is selling too cheap to the market, in order to bring down their excess stock. If sold directly in Antwerp, you could make a lot more for your production.

Also, any new contract with De Beers’ will need to be monitored by the European anti-trust-authorities. It could well be that a simple renewal of the contract will be deemed anti-competitive and illegal.

On the other hand, your great-uncle has borrowed a considerable amount in the bonds-market, and in two years from now, this bond needs to be renewed. The contract with De Beers’ is a guarantee that such a renewal of the loan is not difficult. If however, you decide to start selling on your own, there is a risk that you cannot renew the loan.

Today, you had a first meeting with the representatives of De Beers’. It was quite pleasant. At the end, you realise that nobody is discussing anything essential, and that it feels more like a drink in your country club. Then, you just point out that you do not consider a renewal of the contract as something automatic, and that you clearly want to consider whether it is the best option for your company.

With a rather stiff upperlip, they react to your remark, saying that this needs to be checked carefully, of course. Later that day, you receive the news that a more senior delegation will come and meet you next month.

Day number four, back home, warm and cosy

Back home, you try to summarize what you have learnt.

The good thing, probably, is that you have inherited a diamond mine. Unfortunately, to cover the mining and prospecting investment, your great-uncle had borrowed a large sum on the bonds-market. If you do not renew your contract with De Beers’, you risk not being able to repay that loan.

On the other hand, the government has just taken away 5% of your turnover, by raising export taxes and trying to create a local cutting industry.

Finally, the product-mix that you mine, is not all beautiful big gem-diamonds. The majority is of industrial, or really low-price-quality, and you have to make sure that all keeps getting sold, in order to remain profitable.

Then, you realise that you have to step away from your dream of super-wealthy Scrooge McDuck. You have just entered a business, that you still need to learn, but that is essentially like any other business. If you make sure to take good and wise decisions, and if you are lucky, your business will be profitable. If however, you take it for granted, you will loose enormously.

discuss on the forum

Article Series

This article is part 1 of a 3 part series. Other articles in this series are shown below:

- Just imagine

- The Diamond Industry in 2005

- The diamond industry in 2005 – halfway review