Market of rough diamonds

The basic prediction about the market of rough diamonds was that the upward pressure on prices would continue. That is definitely the case.

On De Beers’ side, there was a price increase of 3% both in January and in June. On top of that, a service-charge of 2% was added in July. Other producers have increased their pricing accordingly.

All in all, current premiums of up to 15% on DTC-boxes on the secondary market might suggest that DTC-rough is still relatively cheap compared to that of other producers.

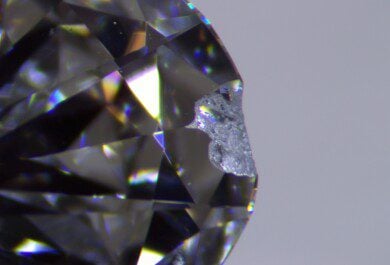

However, more and more players are doubting whether the price increases of rough diamonds are a sign of an inflationary bubble, about to burst. Many sightholders indeed are not cutting their rough at this point in time, but re-selling their boxes with immediate profit. When they need polished diamonds for their customers, it is cheaper to buy that than to have it cut yourself.

Also, I have heard reports of the same rough going from hand to hand for the past months. This might be an indication of a dangerous speculation on ever-increasing prices of rough diamonds.

As for the selection of new sightholders, it was a surprise that 11 new sightholders were selected while no existing ones were ousted.

Alrosa has announced that they are setting up a new distribution channel, which will also work with preferred customers, thus comparable to the DTC sightholder-system. Activity in Moscow is high lately, with many applicants trying to show their strength in order to be first-in-line in the new Alrosa-system.

All in all, there is still a lot of upward pressure on rough prices, but the fear that the bubble might burst begins to come up. Competition in the diamond business these last years has been mainly a competition to obtain the rough, and I do not foresee that changing dramatically in the next months.

Market of polished diamonds

Sometimes, predictions come true sooner than expected. AGS has indeed launched their new cut-grading system for princess-cuts in May, and that for rounds already in June. More amazing is that we can expect new launches from AGS for other shapes in the coming months, maybe even for this year.

GIA gives slightly more information on its upcoming cut-grading system with each new presentation, but it is clear already that the formal launch will at best be for next year.

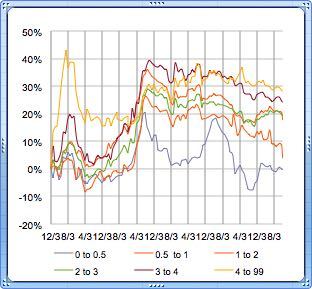

Prices of polished diamonds are slowly going up, but this price increase can in no way be compared to that of rough diamonds.

Supply in stones above 1.50 Cts is very limited, and with many rough dealers speculating on ever-increasing rough prices, production in these sizes is very low too.