- Joined

- Feb 1, 2022

- Messages

- 1

Russia is the largest single country for shipping rough diamonds.

So make the shortage worse raising prices??

As @denverappraiser suggests, the supply chain regarding Russian rough will depend on how strict the sanctions are and how well they will be enforced. Russia accounts for a very large percentage of rough as @Karl_K states above.

We are already hearing from our suppliers that things are tightening. Where this goes it is hard to predict - it is obviously a very fluid situation.

Russia is the largest nation, Africa the largest supplier by continent.

As others have mentioned, India buys the vast majority of all rough from everywhere including from Russia.

Antwerp Belguim and Israel also have many close contacts with Russia and may be hurt more than Indian cutters.

I checked one of my suppliers who list where the rough comes from and around a third by quantity are Russian (too hard to establish value but likely a bit less on average than African diamonds).

It will be interesting and worrisome to see how this plays out!

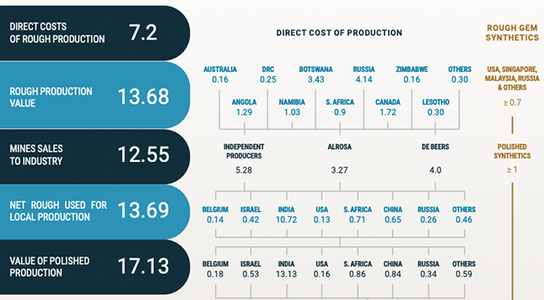

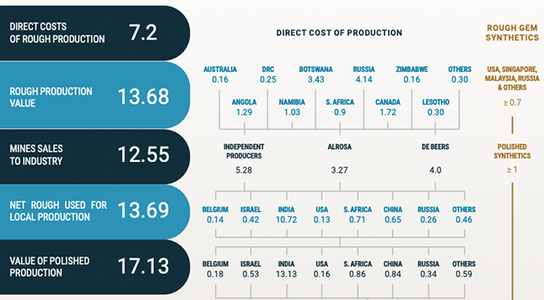

This is from Tacy and is the most accurate - 2019 I believe.

So sad to think of availability getting even tighter - it is day by day I guess.

Very interesting Garry! Just curious, how do you read these charts? What do these numbers stand for? Is it that the direct costs of rough production is 7.2% of the total $ value or something else? Thx

Even sadder to think of the people now suffering in Ukraine. Broke my heart when I saw them huddled in subway stations to use as bomb shelters with their family, pets and what they could carry and not knowing when they will return to their homes.

My suspicion is that removing these sanctions will be like turning an aircraft carrier around. To get all these countries on board and to have them go through the legal and legislative processes necessary to implement sanctions and import bans will not be an easy thing to unspool, even if they succeed in ending Putin's assault on Ukraine.

What should companies that own diamonds that they know to be Russian.....what should they do with those diamonds?

If a given company bought Russian diamonds last year, that they now own....what about those? Flush them?

Clearly, this is not a simple situation.

What did vendors do with Burma stones during that period?