So couple points to address

1)The last data set I uploaded only contains like 10 data points. I'm surprised no one caught this I'll figure out what went wrong when I can get back my computer that ran the crawler.

I'll figure out what went wrong when I can get back my computer that ran the crawler.

2)

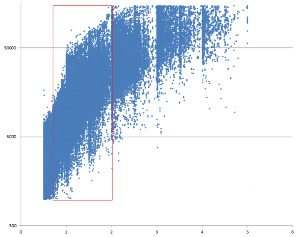

Samples: 303 diamonds

Range: 4241 - 7123 (7123 looks like outlier)

Average: 5320.521

STDDEV: 384.92

Median: 5300

3 sigma is +/- $1200. That's pretty big. So given that, I don't think I'm going to really be able to narrow down my model without including stuff like table, depth, and vendor.

3)

Please note that none of these conclusions relate to the physical appearance of a diamond AT ALL. I'm only talking money.

Here's what my first draft model tells me:

PRICE = -9172.929 + 9073.0*Carat + 1538.85*Cut + 3173.84219*Color + 4315.93*Clarity

Carat is the single largest factor in determining a diamond's price. How does this translate into my purchasing habits? Well, to me diamond diameter is the most important factor of a diamond's size. And given the square - cube law, downgrading on size is the first thing I should do if the price of a stone is too high, and I should be hesitant to upgrade on weight.

My (admittedly weak) first model tells me that each clarity grade is worth $392 and each color grade is $317 and each cut grade is worth

$256. Each carat is worth $9073. (Note this isn't how diamond really pricing works) If this was true, it's a really easy way to make a sound decision if upgrading or downgrading on any parameter is a good idea. I can decide if upping on X parameter is worth Y dollars.

I can't do that yet. But, if I'm successful, and I can eventually draw similar conclusions with a better model. That kind of information, would have been REALLY useful while shopping. Yes, I get each diamond is a special and unique. And exceptions exist to every rule. But at the same time, I'd like to know that this gorgeous diamond someone is trying to sell is in fact 20% above or below market value. Then I can make an educated decision if that 20% is worth it or not.

4)

I could get into other value-added propositions too. Though that's a much more challenging problem. For example, the assistant manager at my local jeweler is a great guy. Super nice, super helpful. Purchasing through my local jeweler would cost me $4500 to buy a stone I like. Buying a stone with the same specifications online would cost me $3800.

Buying locally I would:

a) get to work with a nice guy (I was surprised how much this actually mattered to me. Learn something new every day.)

b) better warranty

c) get to see the stone in person before buying

Buying online I would:

a) Save $700.

I'm the person that would decide my $700 is more valuable than the other intangible benefits. If it was only say $4000 to buy locally, yeah, I might say that's $200 well spent.

5)

1)The last data set I uploaded only contains like 10 data points. I'm surprised no one caught this

2)

I did a quick filter on my data: GIA, 1.0 carart, Ideal Cut, I color, SI1 diamonds.teobdl said:I'm wondering how tight you could get a model even within a subset of these C's: eg. G-H (maybe even I?), VS1-2, 1.0-1.2 ?

Samples: 303 diamonds

Range: 4241 - 7123 (7123 looks like outlier)

Average: 5320.521

STDDEV: 384.92

Median: 5300

3 sigma is +/- $1200. That's pretty big. So given that, I don't think I'm going to really be able to narrow down my model without including stuff like table, depth, and vendor.

3)

This is exactly where I'm going. I'm all about considering the "typical" value of a diamond, or better yet, specific parameters of a diamond. Now, I was hesitant to post this, because everything I'm about to say is wrong. My model sucks. Garbage in, garbage out. But, in some fantasy land where I successfully described diamond pricing, here are some conclusions I could draw.Texas Leaguer said:If the objective is to better understand the macro market forces, your analysis will lead you in that direction. But when it is time to choose a diamond, it will be of limited help...Moreover, it's better to think more in terms of value than price.

Please note that none of these conclusions relate to the physical appearance of a diamond AT ALL. I'm only talking money.

Here's what my first draft model tells me:

PRICE = -9172.929 + 9073.0*Carat + 1538.85*Cut + 3173.84219*Color + 4315.93*Clarity

Carat is the single largest factor in determining a diamond's price. How does this translate into my purchasing habits? Well, to me diamond diameter is the most important factor of a diamond's size. And given the square - cube law, downgrading on size is the first thing I should do if the price of a stone is too high, and I should be hesitant to upgrade on weight.

My (admittedly weak) first model tells me that each clarity grade is worth $392 and each color grade is $317 and each cut grade is worth

$256. Each carat is worth $9073. (Note this isn't how diamond really pricing works) If this was true, it's a really easy way to make a sound decision if upgrading or downgrading on any parameter is a good idea. I can decide if upping on X parameter is worth Y dollars.

I can't do that yet. But, if I'm successful, and I can eventually draw similar conclusions with a better model. That kind of information, would have been REALLY useful while shopping. Yes, I get each diamond is a special and unique. And exceptions exist to every rule. But at the same time, I'd like to know that this gorgeous diamond someone is trying to sell is in fact 20% above or below market value. Then I can make an educated decision if that 20% is worth it or not.

4)

Agreed. If we want to treat diamonds like a differentiable product, then this whole exercise is pretty meaningless. If they're commodities, this kind of analysis holds.Texas Leaguer said:In the final analysis it's necessary to understand more about the combination of individual characteristics of the diamonds themselves in order to make an excellent buy. And the overall value-added proposition associated with a specific purchase including the merchant's reputation and policies.

I could get into other value-added propositions too. Though that's a much more challenging problem. For example, the assistant manager at my local jeweler is a great guy. Super nice, super helpful. Purchasing through my local jeweler would cost me $4500 to buy a stone I like. Buying a stone with the same specifications online would cost me $3800.

Buying locally I would:

a) get to work with a nice guy (I was surprised how much this actually mattered to me. Learn something new every day.)

b) better warranty

c) get to see the stone in person before buying

Buying online I would:

a) Save $700.

I'm the person that would decide my $700 is more valuable than the other intangible benefits. If it was only say $4000 to buy locally, yeah, I might say that's $200 well spent.

5)

Engineer, though I doubt that's a surprise.FrekeChild said:I'm just curious, but what do you do for a living?

300x240.png)