- Joined

- May 17, 2014

- Messages

- 7,294

Could someone kindly explain property tax in the US for me?

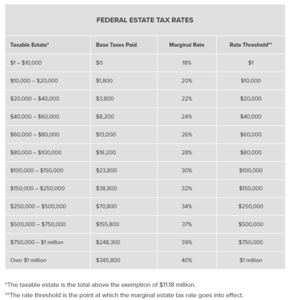

I was told by a person on another forum that your property taxes are really high and it can be a killer to inherit property because of all the tax.

Do you pay tax on your homes? Is it a lot? Do you pay tax on investment properties? Is that a lot too?

I was under the impression that it was some huge amount and people resort to renting because they can't afford property tax but then how can anyone be a landlord then because again there will be taxes.

Hoping someone can satisfy my curiosity!

I was told by a person on another forum that your property taxes are really high and it can be a killer to inherit property because of all the tax.

Do you pay tax on your homes? Is it a lot? Do you pay tax on investment properties? Is that a lot too?

I was under the impression that it was some huge amount and people resort to renting because they can't afford property tax but then how can anyone be a landlord then because again there will be taxes.

Hoping someone can satisfy my curiosity!

300x240.png)