- Joined

- Sep 23, 2011

- Messages

- 5,384

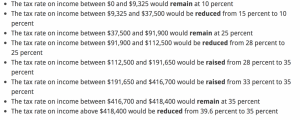

https://www.google.com/amp/heavy.co...ase-decrease-under-new-donald-trump-plan/amp/

I'm not sure what to think of this.. I'm fine with my own taxes going up, but I'm upset to know corporations will be paying less taxes.........

Someone who knows more about taxes and money please explain this like I'm 5 to me..

I'm not sure what to think of this.. I'm fine with my own taxes going up, but I'm upset to know corporations will be paying less taxes.........

Someone who knows more about taxes and money please explain this like I'm 5 to me..

300x240.png)