DreamingOfDiamonds

Shiny_Rock

- Joined

- Oct 4, 2018

- Messages

- 151

This may be a dumb question but how much more more diamonds increase with the tariffs? I’m interested in natural & not lab grown…

rapaport.com

rapaport.com

... perhaps just a previously-planned increase that happened right now.Stones from India are supposed to go up by 27%, I believe. Take a look at this article from Rapaport.

Diamond and Jewelry Trade Braces for Impact of US Tariffs

The US has placed tariffs of 10% on imports from all countries and higher duties on India, prompting concern and uncertainty in the industry.rapaport.com

I was watching some stones on BN and JA in the $650 range. Seems like a couple of them have gone up by $100 dollars or more.

So it seems like the tariffs are hitting.

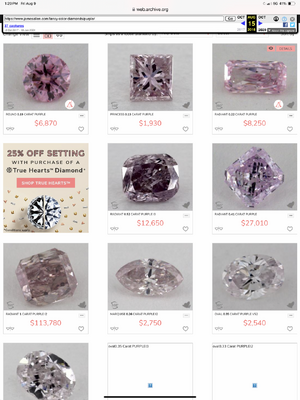

I had an old Pricescope search up that has the cost, but when I click on a stone, it may or may not be that cost. Just saw one that

was on PS listed at $730 but now its $780.

I asked my local jeweler what her take on the tariffs was. Her response, with raised eyebrows, was that her diamond stock just went up 27%, but she was waiting to see how it played out.

Wasn't her stock already purchased and cost sunk??

A lot of stores that own stones work on a rotating stock basis.Wasn't her stock already purchased and cost sunk??

A lot of stores that own stones work on a rotating stock basis.

They buy a 1ct h-vs2 blah blah blah stone.

They sell that stone and replace it in stock and the $$ difference between the sale price and the price to replace it is what keeps the lights on.

If they sold the diamond based on what they paid for it they would either not have the money to buy another and or the money to keep the doors open.

So buy at $1 sold at $1.50 but it costs $1.60 to buy another for stock the rotation stops.

That is why most stocking dealers can not hold the line on prices for long.

Short version — the customer is cash flowing operations. No condemnation as many businesses use a similar approach but I hope they have some cash reserves to stay afloat when the markets correct, and to have some breathing room in general.

We do a similar thing. In our case we determine profit margin, say 15%. If there are 20 pay items that get paid as the project progresses some will naturally occur sooner than others. Early items are front loaded with higher margin. Middle items will have less margin. And items to be completed last will have little to no margin and possibly negative. On larger projects you can get far enough ahead to put some of that cash into interest bearing accounts while you are waiting to take profit on the books. We have a job in progress right now that we’ve been able to realize about $2.5m additional margin in unplanned interest. Until realized, it was considered additional project contingency which would have offset any potential profit fade risk before converting to actual margin. More than that, this process keeps from using our own cash reserves to buy materials, or for those without cash reserves from borrowing money (and paying interest, which naturally creates some profit fade if unplanned).

In our case, we have to assume escalation risk at bid time. These larger projects take 2-4 years to complete. We manage that risk by asking suppliers to tell us what their escalation factors will be for X years out. If they can’t or won’t we have to guess for them. Early procurement helps reduce the risk along with early deliveries, temporary storage yards and potential double handling of materials. Those elements have costs too but are often more manageable & predictable.

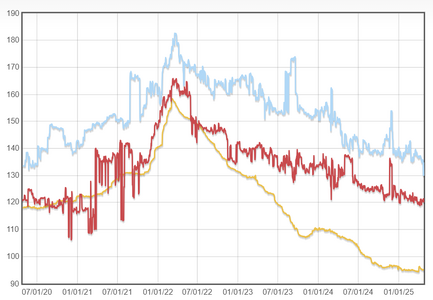

The main driver is China. A lot of companies exported loose diamonds so they could buy gold. When finances are threatened as they are with property there gold is the go to!I speculate it’s a combo of increased LGD market share, reduced natural demand, saturated supply & and overall discretionary product purchase.

If it’s not the bottom in prices and demand – it's close. The diamonds will still be underground when prices rebound.

"It's the economy, stupid"

We just finished a heavy 18kt gold ring. The cost was about almost double than one we made in January.

A $1500 ring would now be $2600

That's without the diamond.

It's possible diamond prices will remain stable- or even drop regardless of tariffs.

exception of FCD that are located outside the U.S.

We've already gotten quite a few emails from large diamond cutters warning of price increases.

It's a weird market in so many ways- even before the tariffs.

Demand for natural diamonds is down.

Even so, that does not mean prices have been much softer.

If we need a stone, it's expensive. If we need to sell a stone we own- to raise cash- we get killed on the cash market.

It's never been "easy" to sell diamonds.

It's harder than ever, which should soften the price. But it's not.

I see this as another move to oligarchy in the diamond business.

"Let them eat lab grown"

The people in charge of these massive cutting companies have so much money, they can afford to sit on the goods and wait.

Likely that consumers who want natural diamonds will be paying more.

Wow, cool research!!!

Although a single stone - especially one as unusual as that one- doesn’t give us any sort of statistical information.

Sites like the one quoted are just portals. The cutter changed the cost, then the site reflects that.

Larger, broad industry changes are happening.