2carathopeful

Rough_Rock

- Joined

- Aug 20, 2018

- Messages

- 11

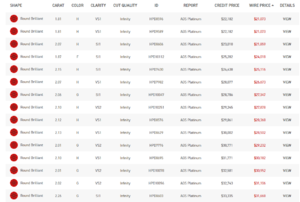

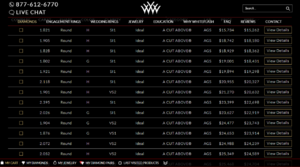

Hey everyone! I'm not entirely sentimental about the diamond I need to buy and would prefer one that a good quality/better "investment" vs one I love and was wondering if the nice people of this forum would help me out? I'm looking round, ~2carats, ideal cut, H/G possible I if it presents a better value, I don't know her ring size but she has small hands, maybe 5 possibly smaller.

Would anyone be able to help find a few choices?

Would anyone be able to help find a few choices?

300x240.png)