TravelingGal

Super_Ideal_Rock

- Joined

- Dec 29, 2004

- Messages

- 17,193

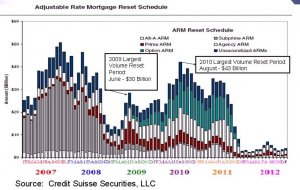

TGuy works in IT at a bank and sent this to me as a colleague of his had to pull some data. Thought some of you might find it interesting. Looks like subprime has had its day of reckoning and the others are yet to come. This is pertinent for us because in our area, most funky loans weren''t subprime, but Alt-A.

300x240.png)