How Are Diamonds Made? Natural vs Lab-Created Explained

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

Buying an engagement ring is an exciting milestone, but it can also be a significant financial commitment. It’s easy to get swept up in the romance and splurge on a ring, but it’s crucial to consider your budget and financial health. If paying for the ring outright isn’t feasible, there are various financing options available to help you manage the cost.

Remember, an engagement ring symbolizes your love and commitment, and it shouldn’t put you in financial hardship. Make sure any financing decision aligns with your long-term financial goals.

Image Source: Energepic.com

Many major jewelers offer financing options, often promoting interest-free financing for a certain period. However, these deals can come with high interest rates if not paid off within the promotional period. We recommend looking into financing options from James Allen or Blue Nile, as they often offer better terms and rates.

This ring offers a payment plan of 3 interest – FREE payments of $613.33

This ring offers a payment plan of 3 interest – FREE payments of $666.67

A personal loan can provide the cash you need upfront with the ability to pay it back over time. Personal loans can be secured (requiring collateral) or unsecured (based on your credit history). However, they often come with initiation fees and high-interest rates, making them less ideal for financing an engagement ring.

Using a credit card is another option, especially if you can find one with zero interest for a promotional period. If zero interest isn’t available, look for a card with a good rewards program. Ensure you can make at least the minimum monthly payments to avoid long-term debt.

If traditional financing routes aren’t suitable, consider alternative options:

When you’re ready to propose, you’re likely also facing other significant financial commitments like a wedding, buying a house, or preparing for a family. Adding debt from an engagement ring can add unnecessary stress.

While we generally advise against financing an engagement ring, if you do need to, choose reputable jewelers to get the best deal. Start your marriage with as little debt as possible, ensuring a financially stable and happy beginning to your life together.

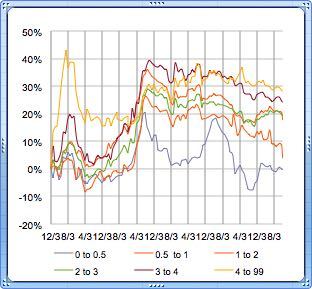

Retail Diamond Prices Chart Updated Monthly.

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

A Wedding Ring as Unique as Your Love Finding the right wedding ring isn’t just about diamonds or gold – it’s about finding the one that feels right. With hundreds…

So, you’re thinking about lab-grown diamonds? Smart move. They’re just as sparkly as the natural kind but usually cost less. But where do you actually go to buy them? It…

Want to stay updated on the most recent blogs, forum posts, and educational articles? Sign up for Bling News, PriceScope’s weekly newsletter.