How Are Diamonds Made? Natural vs Lab-Created Explained

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

An engagement ring is not just a piece of jewelry; it’s a symbol of commitment and love. However, accidents happen, and losing or damaging such a valuable item can be devastating both emotionally and financially. That’s where engagement ring insurance comes into play. In this comprehensive guide, we’ll explore what engagement ring insurance is, why you might need it, associated costs, essential tips for insuring your ring, and questions to ask when considering coverage.

Image Source: Brite Co

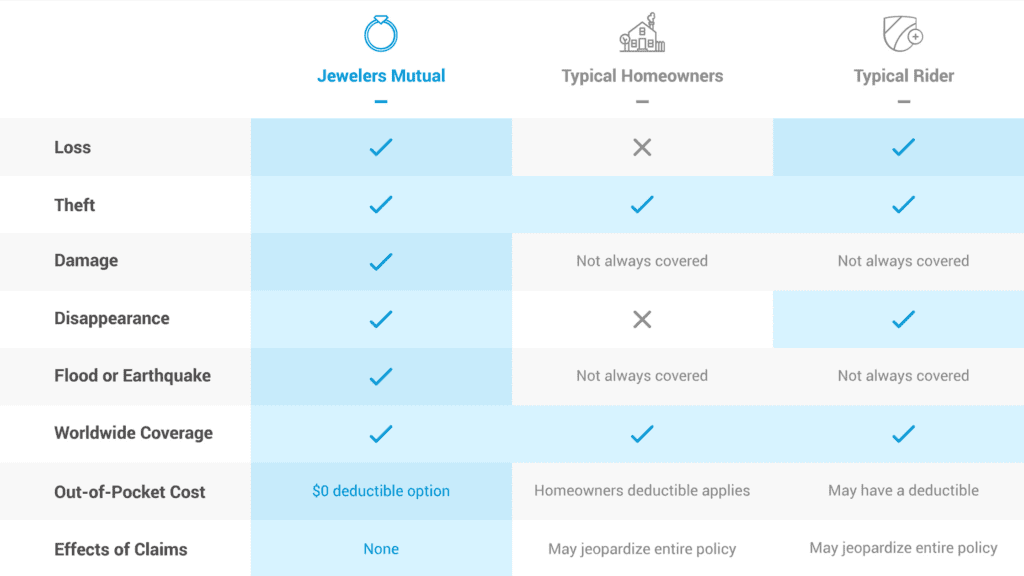

Engagement ring insurance is a specialized form of insurance that protects your ring from loss, theft, damage, or other unforeseen events. While standard homeowner or tenant insurance policies may offer some coverage for personal belongings, they often have limitations when it comes to high-value items like engagement rings. Therefore, getting specific insurance for your ring ensures comprehensive coverage tailored to its value and unique circumstances.

While engagement ring insurance is optional, it’s highly recommended for anyone who owns a valuable ring. Here are some reasons why:

Discover diamond vendors renowned for their premium quality and affordability. Shop exclusive high-quality diamonds and designer engagement rings at Whiteflash. Explore Blue Nile's extensive array of styles, offering something for every taste and preference.

Image Source: Whiteflash

The cost of engagement ring insurance varies depending on factors such as the ring’s appraised value, your location, the deductible amount, and the insurance provider. On average, you can expect to pay around 1-2% of the ring’s appraised value annually for coverage. For example, if your ring is appraised at $5,000, you might pay between $50 and $100 per year for insurance. Whiteflash recommends BriteCo as its top jewelry insurance company.

Image Source: Business Insider

When shopping for engagement ring insurance, be sure to ask the following questions to ensure you’re making an informed decision:

When it comes to safeguarding your precious engagement ring, choosing the right insurance provider is paramount. While various options exist in the market, one standout provider known for their comprehensive coverage and exceptional service is Brite Co.

Ready to embark on your diamond-buying journey? The elite brands offered by our vetted vendors like Whiteflash A CUT ABOVE®, Astor by Blue Nile™, and JamesAllen.com True Hearts™ are collections of diamonds with superior cut quality.

Investing in engagement ring insurance is a smart decision that offers financial protection and peace of mind. By understanding what engagement ring insurance entails, assessing your individual needs, and asking the right questions when shopping for coverage, you can ensure your precious symbol of love remains safeguarded for years to come.

Retail Diamond Prices Chart Updated Monthly.

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

A Wedding Ring as Unique as Your Love Finding the right wedding ring isn’t just about diamonds or gold – it’s about finding the one that feels right. With hundreds…

So, you’re thinking about lab-grown diamonds? Smart move. They’re just as sparkly as the natural kind but usually cost less. But where do you actually go to buy them? It…

Want to stay updated on the most recent blogs, forum posts, and educational articles? Sign up for Bling News, PriceScope’s weekly newsletter.