mayachel

Brilliant_Rock

- Joined

- Mar 2, 2008

- Messages

- 1,749

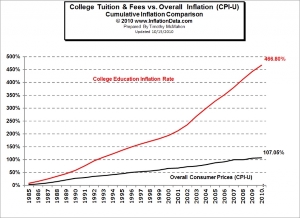

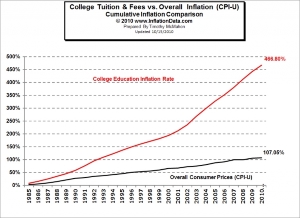

In the past couple of years, loan forgiveness in the US seemed to come up every so often, but I haven't heard a whisper about it in over a year. So, just for the fun of it-what do you think? what have you heard?

I know this is all just speculation, but as someone about to finish grad school, despite only taking some unsubsidized loans, I do feel aware of the massive debt facing me. I have already finished paying back around $20,000 in loans from undergrad, so feel confident that it is doable, but this time around the debt will be sig. higher and interest rates aren't what they were 10 years ago.

I know this is all just speculation, but as someone about to finish grad school, despite only taking some unsubsidized loans, I do feel aware of the massive debt facing me. I have already finished paying back around $20,000 in loans from undergrad, so feel confident that it is doable, but this time around the debt will be sig. higher and interest rates aren't what they were 10 years ago.

300x240.png)