How Are Diamonds Made? Natural vs Lab-Created Explained

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

If you’re looking to insure an engagement ring, luxury watch, or fine jewelry, BriteCo offers a modern alternative to traditional insurers. Founded by a third-generation jeweler, BriteCo brings speed, transparency, and digital convenience to the jewelry insurance process. This review covers what BriteCo insures, how claims work, pricing details, pros and cons, and how it compares to other jewelry insurance providers.

Founded in 2017 by insurtech innovator and third-generation jeweler Dustin Lemick and launched publicly in 2019, BriteCo is a modern jewelry insurance provider based in Evanston, Illinois. The company was created with one clear mission: to bring the outdated jewelry insurance process into the digital age.

Partnering with trusted jewelers across the U.S., BriteCo offers instant insurance coverage for engagement rings, wedding bands, watches, and fine jewelry right from your smartphone or laptop. Unlike traditional insurers, BriteCo leans heavily into tech-driven efficiency: appraisals, policy issuance, and claims are all handled online, often within minutes.

BriteCo is underwritten by AM Best A-rated carriers and backed by global reinsurers, offering peace of mind to anyone insuring a high-value piece.

Insuring Your Jewelry Just Got Easier

PriceScope recommends BriteCo for fast, fully digital coverage with zero deductibles and 125% replacement value. Get your free quote in 30 seconds.

BriteCo policies are designed for everyday risks. Whether you lose an engagement ring at the gym or your watch gets stolen while on vacation, their comprehensive coverage has you covered.

BriteCo also covers repairs and replacements at up to 125% of the item’s appraised value, ensuring you’re not out of pocket if market prices rise.

Filing a claim with BriteCo is simple and can be done entirely online. Here’s how it typically goes:

What sets BriteCo apart is their commitment to working with your original jeweler, whenever possible. That means continuity in craftsmanship and peace of mind.

Why We Trust BriteCo with Our Own Jewelry

Policies start around $5 per month and cover what homeowners insurance often misses. Expect strong coverage, zero deductibles, and clear terms.

Start your coverage now

BriteCo offers free online quotes based on your jewelry’s appraised value, your location, and some risk factors. Policies typically cost 0.5% to 1.5% of the item’s value annually. For example, if your engagement ring is appraised at $6,000, you could pay around $30 to $90 per year to insure it.

Another bonus? If you get your appraisal done through a BriteCo partner jeweler, the coverage quote and valuation are often built into the same process, saving time and money.

Coverage begins immediately upon payment, and you can manage everything from a sleek user dashboard.

Skip the Hassle and Get Covered in Minutes

BriteCo lets you insure jewelry directly online and manage claims through your chosen jeweler. No paperwork, no waiting.

Lock in your quote

Compared to legacy providers like Jewelers Mutual or Chubb, BriteCo offers a faster and more transparent experience. Their digital-first approach makes them ideal for tech-savvy buyers who want clarity and control.

BriteCo also tends to offer lower premiums than homeowners’ insurance riders, and unlike many homeowners policies, they cover mysterious loss and often don’t require a deductible.

Jewelers Mutual remains a strong competitor with decades of history, but BriteCo’s modern UX and flexible coverage make it particularly appealing to newer generations of buyers.

BriteCo is a great fit for:

Protect Your Ring, Watch, or Heirloom

BriteCo’s standalone jewelry insurance is affordable, backed by A+ carriers, and covers loss, theft, damage, and mysterious disappearance.

See your instant quote

Getting covered with BriteCo is easy:

There’s no obligation, and you can cancel or update your policy anytime.

If you’re looking for affordable, fast, and comprehensive jewelry insurance, BriteCo is a strong contender. BriteCo insurance offers easy-to-use online tools, strong coverage terms, and positive user reviews, it’s especially appealing for engagement ring buyers and collectors who want peace of mind without the paperwork.

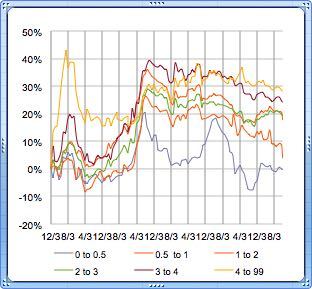

Retail Diamond Prices Chart Updated Monthly.

Two Paths, One Diamond Not all diamonds come from the same place — but they all start the same way. Pure carbon, crystalized under immense pressure and heat. Whether it…

A Wedding Ring as Unique as Your Love Finding the right wedding ring isn’t just about diamonds or gold – it’s about finding the one that feels right. With hundreds…

So, you’re thinking about lab-grown diamonds? Smart move. They’re just as sparkly as the natural kind but usually cost less. But where do you actually go to buy them? It…

Want to stay updated on the most recent blogs, forum posts, and educational articles? Sign up for Bling News, PriceScope’s weekly newsletter.