Hi

Quick Question please, I read your description Lestat, about origin,

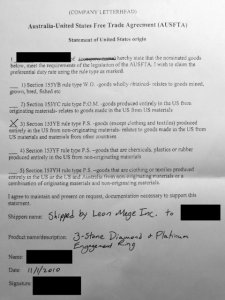

My question, my australian e-ring stones are being used as sidestones in the new WF 3 stone e-ring setting. Do you think this still woulld be OK as it is an australian stone with US???? Love to know a bit more before I speak to customes and just get brushed off by the wrong person iykwim.

THANKS so much, even if it doesnt apply to me, it is still so good for all us aussies to know

d2b

Quick Question please, I read your description Lestat, about origin,

My question, my australian e-ring stones are being used as sidestones in the new WF 3 stone e-ring setting. Do you think this still woulld be OK as it is an australian stone with US???? Love to know a bit more before I speak to customes and just get brushed off by the wrong person iykwim.

THANKS so much, even if it doesnt apply to me, it is still so good for all us aussies to know

d2b

300x240.png)