- Joined

- Aug 15, 2000

- Messages

- 18,455

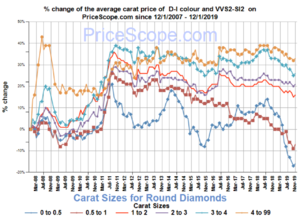

I think they missed the impact of online sales on retail pricing.

A fall in retail purchases in $ terms has been happening in most countries as online vendors (and PS) create more transparent markets and lower retail margins.

The volume or quantity of sales is harder to measure for bean counters.

Our measures also show falls in costs per stone, so the actual volume or qty has probably risen quite a lot

300x240.png)