- Joined

- Aug 15, 2000

- Messages

- 18,457

Martin Rapaport gives a breakfast address every year at the Vegas JCK trade show.

I made these notes as he spoke – they may not all be coherent as he talks like a gatling gun.

I have most of the slides too, so if anyone wants specific detail I can post the slides.

Diamond Market:

Rough 15b

Polished 20b

Jewellery 65b

Usa 51%, China 12%, India 3%, Japan 6%

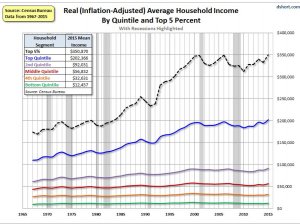

Trump will grow American consumers

3 top issues

Retail profitability. Big concern.

Radical political change. New tax changes

Source certification. Terrorist funding

RETIAL.PROFITABILITY

Change adaption

External internal. E.g CVDs

Change change change

Profit life cycle e.g. fax sales

So come up with new ideas and products eg rap lost then mag then RapNet then auctions

Elite Daily news web EXPERIENCES not goods. Life is about memories not diamonds. THATS HOW MILLENIALS THINK. But when a woman looks at her ring she remembers the life and the man who bought it for her. That's the IDEA behind the diamond.

More millennials now than boomers. 27%

INTERNET "will never replace store experience!" Rap laughs - Hahahaha

Price transparency

It is how we communicate

Everyone communicates. Leaders. Segments etc engage with people. Then swll stuff to hundreds of thousands of people.

Disintermediatization

Can a diamond miner sell to consumers. YES

Manufacturers and dealers can bypass retailers. But not that simple. Eg Blue Nile is opening showrooms

BRANDING

Legal monopoly to sell TRUST and PROMISE

Amazon promise is to kill competitor's

Consolidated marketing like the watch companies. Canadamark?

Could FOREVERMARK be the new Rolex????

PROFIT for retailers

Its all about added value.

It costs 40% to open the doors.

Blue Nile can do it for half as much.

Value = quality (perceived) / price

Its the entire value proposition.

He service. The security. The happiness. The better your perception in clients mind.

V=Q/P

we have to make V greater than 1.00

WHAT IS OUR BUSINESSES Q???

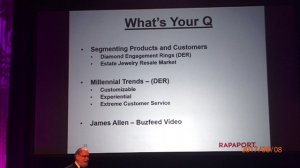

Segment your products

Segment your clients. Rich dumb smart old young

Customizable

Experience

Extreme customer service

We must not lose the engagement ring market

IT MUST BE AN Experience

JAMES ALLEN buzzfeed video - yes, online can beat B&M experiences:

Your staff need to have great experiences if they are gunna give it to clients.

Bain take BlueBile private for $500M

James Allen get $140M for 50% of the company.

Brilliant Earth – great story, but are they really ethical?

All opening Tesla style show rooms EXPERIENTIAL!!!!

The Process

.innovation ..communication tech

.disruption...how you meet and greet and help sell to customers

.segmentation. ..people stuff communication

.curation... your expertise. Choose customer segment. Give em what they want

Today there is so much news it is like drinking from a fire hydrant

FIND YOUR 'Q'

BE THE BEST AT SOMETHING in the world

What are you passionate about? What do you have ability to do?

Then your V equals PROFIT

Hire young people. Ones with a passion for jewellery.

Treat them well. That’s how you get extreme customer service. Foosball chairs.

Evolve from price and product to communication competition.

Get client acquisition right and you get sales as a by product.

Relationships lead to business. That’s where the world is going.

Be authentic

Tell.em.what you do best

Segment

We live in a multi channel world. FB misses some. Email is for old dudes.

Instagram for others.

Don’t throw out what you do now and do well

Rap did a CEO Harvard course. Case study about Ringling circus that went broke. Hate animals being abused. Dusty. Dirty smelly. Circe de Solae worked out how to make a circus that works.

How do we do that transition?

Target story. King Solomon. “How did you hit the center of the target every time kid?” “I draw the circle around target after I shoot the arrow into the tree”

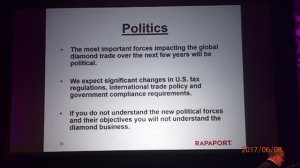

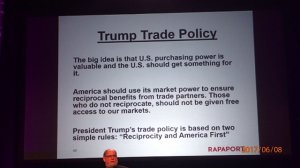

POLITICS

Big impact on the diamond macro market.

Tax changes

Trade policy

You better understand it baby!

US purchasing power is what Trump will use. China better reciprocate. Don’t build islands if you want is to let you sell to our country. Reciprocity

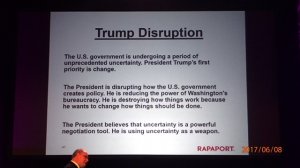

He is a huge mother of disruption. He couldn't give a stuff about destruction of Washington bureaucracy. He wants to break it and start again. That’s why people voted for him.

He has the house and the senate.

So he will change tax

1 trillion in infrastructure

Money will flow. Gold in the streets.

1000 billion

China will want to build islands near Manhattan

BAT border adjusted tax. It’s a republican policy. Tax on imports. 10% to 20% but less business taxes. And tax refunds for importation.

He is an insurgent.

Less imports more stuff made in USA and jobs.

The US $ will get stronger.

About now the slides projector died

TERRORISM

Bombs everywhere

Hard to open a bank account

Costs for banks to monitor money movements

Patriot act is looking at the diamond trade! They are looking at us. Same in Australia.

Where do my diamonds come from (eg my best supplier tells me. Botswana. Canada. Russia on every diamond.)

Big brands can be hit with just one mistake eg Signet share price dropped because they underpaid some staff. Imagine Tiffany was found to be selling conflict diamonds. So they are spending and working on CSR.

Is it environmentally safe? Do you know? Supply chain

CONCLUSION

Changes. Threat, internet, multichannel

Don't rely on technology though because it keeps changing.

Radical changes. Trump smashing systems.

If he spends and changes tax - USA will grow fast.

The word is EXTREME

Learn. Study. Grow. Understand. If it is not working it's your own fault.

Thank you

MARTIN RAPAPORT

I made these notes as he spoke – they may not all be coherent as he talks like a gatling gun.

I have most of the slides too, so if anyone wants specific detail I can post the slides.

Diamond Market:

Rough 15b

Polished 20b

Jewellery 65b

Usa 51%, China 12%, India 3%, Japan 6%

Trump will grow American consumers

3 top issues

Retail profitability. Big concern.

Radical political change. New tax changes

Source certification. Terrorist funding

RETIAL.PROFITABILITY

Change adaption

External internal. E.g CVDs

Change change change

Profit life cycle e.g. fax sales

So come up with new ideas and products eg rap lost then mag then RapNet then auctions

Elite Daily news web EXPERIENCES not goods. Life is about memories not diamonds. THATS HOW MILLENIALS THINK. But when a woman looks at her ring she remembers the life and the man who bought it for her. That's the IDEA behind the diamond.

More millennials now than boomers. 27%

INTERNET "will never replace store experience!" Rap laughs - Hahahaha

Price transparency

It is how we communicate

Everyone communicates. Leaders. Segments etc engage with people. Then swll stuff to hundreds of thousands of people.

Disintermediatization

Can a diamond miner sell to consumers. YES

Manufacturers and dealers can bypass retailers. But not that simple. Eg Blue Nile is opening showrooms

BRANDING

Legal monopoly to sell TRUST and PROMISE

Amazon promise is to kill competitor's

Consolidated marketing like the watch companies. Canadamark?

Could FOREVERMARK be the new Rolex????

PROFIT for retailers

Its all about added value.

It costs 40% to open the doors.

Blue Nile can do it for half as much.

Value = quality (perceived) / price

Its the entire value proposition.

He service. The security. The happiness. The better your perception in clients mind.

V=Q/P

we have to make V greater than 1.00

WHAT IS OUR BUSINESSES Q???

Segment your products

Segment your clients. Rich dumb smart old young

Customizable

Experience

Extreme customer service

We must not lose the engagement ring market

IT MUST BE AN Experience

JAMES ALLEN buzzfeed video - yes, online can beat B&M experiences:

Your staff need to have great experiences if they are gunna give it to clients.

Bain take BlueBile private for $500M

James Allen get $140M for 50% of the company.

Brilliant Earth – great story, but are they really ethical?

All opening Tesla style show rooms EXPERIENTIAL!!!!

The Process

.innovation ..communication tech

.disruption...how you meet and greet and help sell to customers

.segmentation. ..people stuff communication

.curation... your expertise. Choose customer segment. Give em what they want

Today there is so much news it is like drinking from a fire hydrant

FIND YOUR 'Q'

BE THE BEST AT SOMETHING in the world

What are you passionate about? What do you have ability to do?

Then your V equals PROFIT

Hire young people. Ones with a passion for jewellery.

Treat them well. That’s how you get extreme customer service. Foosball chairs.

Evolve from price and product to communication competition.

Get client acquisition right and you get sales as a by product.

Relationships lead to business. That’s where the world is going.

Be authentic

Tell.em.what you do best

Segment

We live in a multi channel world. FB misses some. Email is for old dudes.

Instagram for others.

Don’t throw out what you do now and do well

Rap did a CEO Harvard course. Case study about Ringling circus that went broke. Hate animals being abused. Dusty. Dirty smelly. Circe de Solae worked out how to make a circus that works.

How do we do that transition?

Target story. King Solomon. “How did you hit the center of the target every time kid?” “I draw the circle around target after I shoot the arrow into the tree”

POLITICS

Big impact on the diamond macro market.

Tax changes

Trade policy

You better understand it baby!

US purchasing power is what Trump will use. China better reciprocate. Don’t build islands if you want is to let you sell to our country. Reciprocity

He is a huge mother of disruption. He couldn't give a stuff about destruction of Washington bureaucracy. He wants to break it and start again. That’s why people voted for him.

He has the house and the senate.

So he will change tax

1 trillion in infrastructure

Money will flow. Gold in the streets.

1000 billion

China will want to build islands near Manhattan

BAT border adjusted tax. It’s a republican policy. Tax on imports. 10% to 20% but less business taxes. And tax refunds for importation.

He is an insurgent.

Less imports more stuff made in USA and jobs.

The US $ will get stronger.

About now the slides projector died

TERRORISM

Bombs everywhere

Hard to open a bank account

Costs for banks to monitor money movements

Patriot act is looking at the diamond trade! They are looking at us. Same in Australia.

Where do my diamonds come from (eg my best supplier tells me. Botswana. Canada. Russia on every diamond.)

Big brands can be hit with just one mistake eg Signet share price dropped because they underpaid some staff. Imagine Tiffany was found to be selling conflict diamonds. So they are spending and working on CSR.

Is it environmentally safe? Do you know? Supply chain

CONCLUSION

Changes. Threat, internet, multichannel

Don't rely on technology though because it keeps changing.

Radical changes. Trump smashing systems.

If he spends and changes tax - USA will grow fast.

The word is EXTREME

Learn. Study. Grow. Understand. If it is not working it's your own fault.

Thank you

MARTIN RAPAPORT

300x240.png)