First post. Been lurking for awhile. In a way, my specs are very simple.

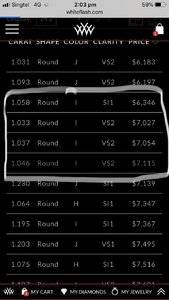

Budget: under $7500, caret: 1ct, color: I and above, clarity: SI1 eye clean n above

Due to my locality, there is no way I can view any of the stones so have limited my options to BGD, WF ACA and CBI

However if you were to look at the inventory then there’s a few more WF aca on offer (think there’s about 4-5 stones) but a comparative stone from CBI is almost $1k more expensive.

Yet reading through the forums and I think I’ve selected and read all the WF, CBI threads, there seems to be a fascination with CBI diamonds.

Qs: is it really worth paying the premium for a CBI?

Here comes another dilemma: if there was a loose ‘second hand’ CBI diamond within your budget with all the paperwork which I could send for verification n appraisal.. and the seller was happy to give 15-20% discount to save him the hassle of sending back, but you would lose all benefits such as buyback or future upgrades .. would u do it ?

Budget: under $7500, caret: 1ct, color: I and above, clarity: SI1 eye clean n above

Due to my locality, there is no way I can view any of the stones so have limited my options to BGD, WF ACA and CBI

However if you were to look at the inventory then there’s a few more WF aca on offer (think there’s about 4-5 stones) but a comparative stone from CBI is almost $1k more expensive.

Yet reading through the forums and I think I’ve selected and read all the WF, CBI threads, there seems to be a fascination with CBI diamonds.

Qs: is it really worth paying the premium for a CBI?

Here comes another dilemma: if there was a loose ‘second hand’ CBI diamond within your budget with all the paperwork which I could send for verification n appraisal.. and the seller was happy to give 15-20% discount to save him the hassle of sending back, but you would lose all benefits such as buyback or future upgrades .. would u do it ?

300x240.png)